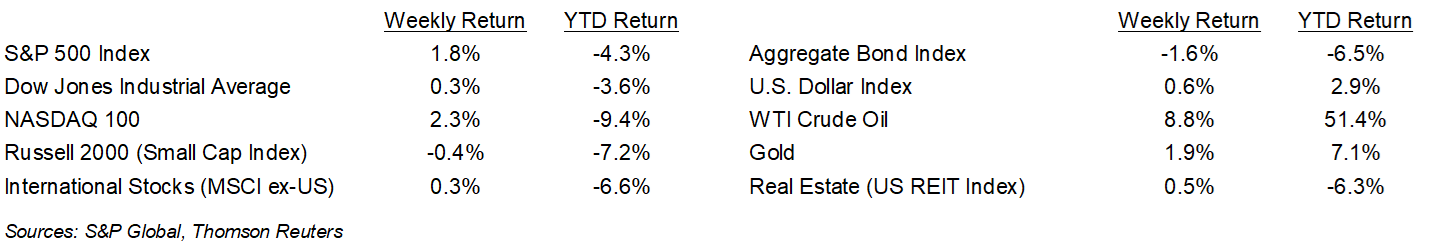

Equity market investors appear to be learning how to live with higher interest rates and prospects for a drawn-out engagement between Russia and Ukraine. The S&P 500 Index ended the week +1.8%, the Dow was +0.3%, and the NASDAQ was +2.3%. The 10-year U.S. Treasury bond yield increased to 2.488% at Friday’s close versus 2.153% the previous week.

Chair Jerome Powell said last Monday that the Federal Reserve would raise its benchmark short-term interest rate faster than expected, and high enough to restrain growth and hiring, if it decides this would be necessary to slow rampaging inflation. If necessary, the Fed would be open to raising rates by a more aggressive 0.50% at multiple Fed meetings.

Five companies in the S&P 500 Index report earnings this week. The current consensus for 1Q22 is 6.4% earnings growth on 10.9% revenue growth.

In our Dissecting Headlines section, we explain the term Stagflation, which has recently crept into financial headlines.

Financial Market Update

Dissecting Headlines: Stagflation

Recent comments from Fed Chair Jerome Powell that the Fed would be willing tighten money policy faster to fight inflation, even at the cost of growth and hiring, has prompted the word “stagflation” to emerge.

Stagflation is a portmanteau formed from the words “stagnation” and “inflation”. It characterizes an economy by slow, or stagnated, growth combined with rising prices, i.e. inflation. Since two of the Fed’s primary mandates are employment and price stability, there can be periods when monetary policy needs to address one or the other condition. High unemployment can be fought with accommodative monetary policy (lower interest rates and high liquidity). Inflation can be fought by tighter monetary policy (higher interest rates) to slow demand. Originally coined in the 1960’s in the UK, the phrase entered the American vocabulary in the 1970’s as a result of the oil crisis which prompted a combination of economic recession and higher commodity prices.

Concerns have been raised that the Fed waited too long to address inflationary pressures because of the need to shepherd a return to full employment during COVID. The result is the current catch-up actions where the Fed may need to move further and faster to curb inflation, even at the cost of jobs. The delicate dance between the two will likely reveal itself over coming months. With the job market tight, stagflation doesn’t appear to be a likely outcome imminently, but the persistence of inflation against monetary tightening could prompt concern if current employment trends reverse course quickly. The Fed is aiming for a “soft landing” where it is able to tighten monetary policy to curb inflation, but still maintain healthy GDP growth and employment.

The recent Summary of Economic Projections, released at the March Federal Open Market Committee (FOMC) meeting, indicated the median Fed funds rate expected by the end of 2022 is 1.9% (range of 1.75% to 2.00%). This could be accomplished by six more 0.25% moves between now and year-end, one at each of the remaining FOMC meetings. It could also be accomplished sooner by a series of 0.50% increases. The next FOMC meeting is scheduled for May 3rd to 4th and should provide investors the next clue in the Fed’s actions.

________________________________________

Want a printable version of this report? Click here: NovaPoint March 28, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.