Heading into the tail-end of the second quarter earnings season, 441 companies in the S&P 500 have reported earnings with 82% reporting results above consensus. This is better than the long-term average of 64.9%. A fourth consecutive better than expected week has moved current consensus for second quarter S&P 500 earnings to down 31.7% year-over-year versus -33.8% last week. Expectations a month ago were for earnings to be down 44% year-over-year when the reporting season kicked off.

This week we should continuing to see some political wrangling as Congress continues debating a next round of stimulus measures. As talks deadlocked last week, the President signed an executive order to take some measures to bridge the gap including a $400/week enhanced unemployment benefit, a temporary elimination of the payroll tax for workers earning less than $100,000/year, and some protections for student loans and renters. Negotiations should resume this week for a broader solution.

After a brief stall the week of July 25th, the weekly initial unemployment claims continued their downward trend. Initial unemployment claims for the week of August 1st decreased to 1.186 million versus 1.435 million the week prior. Continuing Claims for July 25th were 16.107 million versus 17.018 million the week prior. The July Employment Report showed 1.8 million jobs created and the unemployment rate declined to 10.2%.

In addition to employment, other economic data is supporting a rebound in the economy. The Institute for Supply Management (ISM) reports for both manufacturing and services are indicating expansion. For July, the ISM manufacturing index had a reading of 54.2 and the services index had a reading of 58.1. A value over 50 indicates expansion and a value below 50 indicates contraction. Important in both reports were data indicating new order activity was strong, with readings in both reports above 60.

In our Dissecting Headlines section, we look at recent Consumer Credit activity.

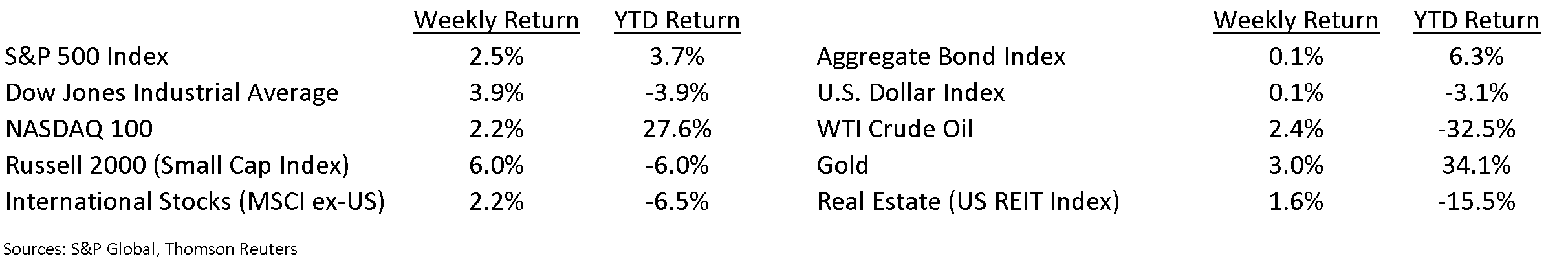

Financial Market Update

Dissecting Headlines: Consumer Credit

Consumer credit is the personal debt that a person draws on to purchase a variety of goods and services. It can take the form of installment credit for items like automobiles or revolving credit which typically is a credit card. Mortgages for home purchases are classified differently.

According to data from the Federal Reserve, consumer credit decreased at a 6.75% rate in the second quarter of 2020, with revolving credit decreasing at 31.75%. Some of the reasons for the decline are COVID related. Spending decline during the second quarter as consumers hunkered-down due to uncertainties with employment and the economy, as well as having a lower ability to spend as many restaurants, retail and travel outlets were closed during the lockdowns. Mortgage rates declined as well some refinance dollars may have gone toward paying down higher interest rate revolving debt.

We’ve seen spending recover June and July. This coming Friday the July retail sales data is scheduled for release. While consumer spending is a key factor toward recovery, consumers maintaining a healthy personal balance sheet is also an important balance to strike.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint August 10, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.