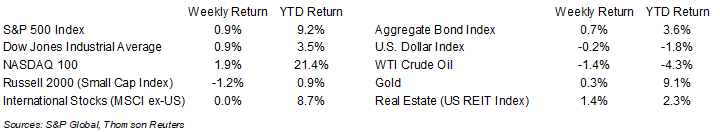

The S&P 500 Index ended the week +0.9%, the Dow was +0.9%, and the NASDAQ was +1.9%. The 10-year U.S. Treasury note yield decreased to 3.452% at Friday’s close versus 3.572% the previous week.

Regulators closed First Republic Bank over the weekend and sold all of its deposits and most of its assets to JPMorgan Chase. This is the third bank failure, following Silicon Valley Bank and Signature Bank. The bank’s branches will open Monday as JPMorgan Chase. Two key events for the coming week are the Federal Open Market Committee (FOMC) rate decision scheduled for Wednesday and the April employment report scheduled for Friday.

We are past the halfway point on first quarter earnings reporting with 267 companies already reported and another 162 scheduled for this week. For the first quarter, the S&P 500 Index is expected to see earnings decline 1.9% on revenue growth of 2.3%. The outlook for the quarter has improved since the start of earnings season three weeks ago when consensus was a 5.2% earnings decline on revenue growth of 1.6%. Of the 267 companies that have reported so far, 77.9% have reported earnings above consensus. For full year 2023, S&P 500 Index earnings are expected to grow 1.1% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at the upcoming Federal Open Market Committee meeting.

Financial Market Update

Dissecting Headlines: Fed Meeting

The Federal Reserve’s Federal Open Market Committee (FOMC) meets this week for a two-day meeting on May 2nd and 3rd. The FOMC has raised short term interest rates at each of its last nine meetings. Prior to the March 2022 meeting, the Fed funds target rate range was 0.00% to 0.25%. The current target rate range heading into the May 2023 meeting is 4.75% to 5.00%.

The FOMC has a lot to factor into its decision making at this and subsequent meetings. Inflation has cooled since last summer, but is still ahead of the Fed’s 2.0% annual range. The March Personal Consumption Expenditures (PCE) Price Index showed inflation 4.2% higher year-over-year and core inflation, which excludes food and energy, 4.6% higher year-over-year. The March unemployment rate stood at 3.5% and the forecast for April is only a modest increase to 3.6%. The FOMC has been willing to trade an increase in unemployment for a reduction in core inflation.

The increase in rates has had some impact on Gross Domestic Product (GDP) growth as the first quarter advance GDP report showed the U.S. economy grew at a 1.1% rate, slower than the fourth quarter rate of 2.6%. Economists still appear split as to whether the U.S. economy will enter a recession as a result of the Fed’s rate increases. It is still the Fed’s contention that the U.S. economy can have a “soft landing”, albeit with very slow overall growth. Current FOMC projections for GDP growth are 0.4% for 2023 and 1.2% for 2024.

The last important point for the FOMC to consider is the stability of the financial system. As mentioned above, First Republic Bank has become the third bank failure this year. The Fed and bank regulators have been able to maintain financial stability by orderly closings of First Republic and the two other banks, Silicon Valley Bank and Signature Bank. Several Fed officials have commented that lending restrictions from tighter bank conditions can serve a similar purpose to rate increases with regard to slowing growth.

We think the FOMC will increase rates by 0.25% this week. This would put the Fed funds rate at the FOMC’s last stated terminal rate range of 5.00% to 5.25%. After that, future policy actions likely depend on the continued progress on inflation.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 1, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.