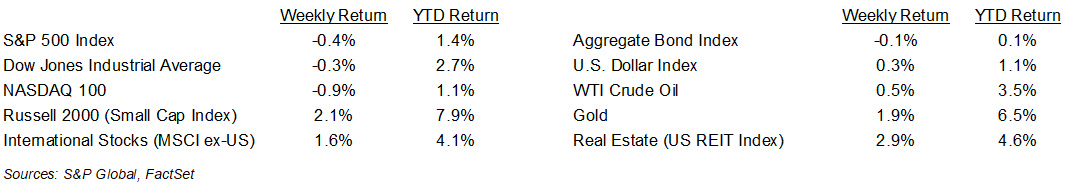

A positive fundamental outlook for stocks risks being blunted by geopolitical concerns. Last week, the S&P 500 Index was -0.4%, the Dow Jones Industrials -0.3%, and the NASDAQ -0.9%. The Real Estate, Consumer Staples, and Industrial sectors led the S&P 500 Index for the week, while the Financials, Consumer Discretionary, and Communication Services sectors lagged. The 10-year U.S. Treasury note yield was 4.226% at Friday’s close versus 4.167% the previous week.

The rhetoric over Greenland between the U.S. and Europe is likely to be a dominant theme at the World Economic Forum meeting in Davos, Switzerland this week. As often happens, geopolitical headlines can overtake economic and business fundamentals and drive market sentiment for short periods of time.

Concerns over a reemergence of inflation have yet to materialize. The December Consumer Price Index (CPI) was 0.3% higher month-over-month and 2.7% higher year-over-year. Core CPI, which excludes food and energy prices, was 0.2% higher month-over-month and 2.6% higher year-over-year. The Federal Reserve is likely to maintain a wait and see approach at its January policy meeting and CME Fed funds futures are currently forecasting a single 0.25% reduction in the Fed funds rate at the June meeting.

The holiday shortened week sees a gradual ramp-up in earnings reports with 35 companies in the S&P 500 Index scheduled to report earnings. Quarterly earnings are expected to grow by 8.2% with revenue growth of 7.8%. Full-year 2025 earnings are expected to grow by 12.4% with revenue growth of 7.2% and 2026 full-year earnings are expected to grow by 14.9% with revenue growth of 7.3%.

In our Dissecting Headlines section, we look at current investor sentiment.

Financial Market Update

Dissecting Headlines: Investor Sentiment

Despite the equity market having a down week, investor sentiment has grown more positive in the new year. The American Association of Individual Investors Sentiment Index has seen Bullish sentiment rise to 49.5% versus 42.0% at the start of the year and above its historical average of 37.5%. The 49.5% Bullish reading is the highest in over a year. The Index’s Bearish sentiment has risen to 28.2% versus 27.0% at the start of the year, but below its historical average of 31.0%. The Index asks investors where they believe the stock market will be in the next six months, higher (Bullish), lower (Bearish), or the same (Neutral). Extreme position in sentiment, either Bullish or Bearish, can often be a contrarian indicator for socks.

Geopolitical concerns could pressure investor sentiment in the near-term. The Trump administration has threatened to impose tariffs on several European countries unless they agree to U.S. demands related to Greenland. Beginning February 1st, the countries would face a 10% tariff on their exports to the U.S. The tariff rate would then rise to 25 % on June 1st if no agreement on Greenland is reached.

With many world leaders and business executives meeting in Davos this week, these geopolitical issues could weigh on investor sentiment in the near-term while events play out.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 20, 2026

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.