The equity market rebounded strongly at the start of last week but declined sharply on Friday following a stronger employment report. Despite Friday’s decline, the major markets held on to gains for the week. The S&P 500 was +1.6%, the Dow was +2.0%, and the NASDAQ was +0.7%. The 10-year U.S. Treasury note yield increased to 3.885% at Friday’s close versus 3.804% the previous week. Crude oil rose 16.5% following an OPEC+ decision to reduce oil output quotas by two million barrels per day.

The economy produced 263,000 net new jobs in September. This was ahead of the consensus forecast of 250,000. Job gains were led by the Education and Health Services industry (+90,000 jobs), the Leisure and Hospitality industry (+83,000) and the Professional and Business Services industry (+83,000). Job declines were seen in the Government (-25,000), Financial industry (-8,000), Transportation and Warehousing industry (-7,900), and the Retail industry (-1,100). The unemployment rate declined to 3.5% from 3.7% in August.

The continued strength in the labor market gives the Federal Reserve runway to keep raising rates until it sees a meaningful decline in inflation. There is a sense that higher rates will eventually take its toll on the labor market, but this is likely to be a slow bleed versus a sharp drop.

The third quarter earnings season kicks off this week with 14 companies reporting earnings. The current consensus expectation for the third quarter is 4.1% earnings growth on 9.7% revenue growth. For the full-year 2022 earnings growth is currently forecast at 7.4% on 11.6% revenue growth.

In our Dissecting Headlines section, we look at expectations for the upcoming third quarter earnings reporting season.

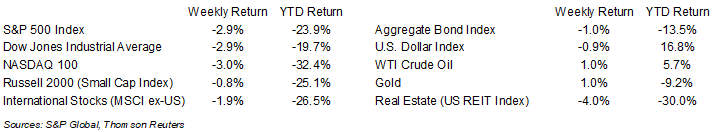

Financial Market Update

Dissecting Headlines: Third Quarter Earnings

Third quarter earnings reporting season starts this week. The current consensus expectation is 4.1% earnings growth on 9.7% revenue growth. Within sectors, there is a meaningful disparity in the level of year-over-year growth. Based on consensus data from Refinitiv, only four of the eleven economic sectors are expected to show positive growth in earnings: Energy (+121.0% earnings growth year-over-year), Industrials (+26.3%), Consumer Discretionary (+13.5%), and Real Estate (+11.0%).

The remaining seven sectors are projected to show a contraction in year-over-year earnings: Materials (-2.1%), Consumer Staples (-2.4%), Information Technology (-3.5%), Health Care (-4.2%), Utilities (-7.4%), Financials (-10.5%), and Communications Services (-16.1%).

Key data and commentary to look for in the upcoming earnings reports include the impact of higher interest rates, material and labor inflation, observed areas of economic slowing, potential layoffs, and impact of a stronger dollar on earnings. At the same time investors are navigating the earnings reports, the macroeconomic backdrop of inflation should continue to impact overall market sentiment leading into the November Federal Open Market Committee (FOMC) meeting on November 1st – 2nd. The outcome of the U.S. midterm elections could also impact market sentiment as we close out the earnings reporting season in November.

________________________________________

Want a printable version of this report? Click here: NovaPoint October 10, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.