We head into the end of the first quarter with all three major U.S. equity indices positive for the year. We are fortunate to be in a better economic and social environment versus this time last year when the initial impact of the COVID-19 pandemic was driving equity markets lower and forcing people into lock-downs.

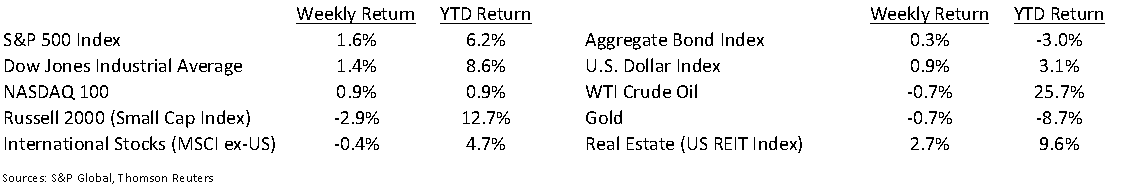

The Dow Jones Industrial Average closed the week +1.4%, the S&P 500 Index was +1.6%, and the NASDAQ 100 Index was +0.9%. The 10-year U.S. Treasury yield moved lower on the week to 1.660% at Friday’s close versus 1.732% the previous week. In testimony last week, Fed Chair Jerome Powell and Treasury Secretary Janet Yellen supported the thesis that any current inflationary pressures are transitory from the COVID rebound versus long-run inflation pressures.

Initial unemployment claims for the week of March 20th decreased to 684,000 versus the previous week at 781,000. Continuing claims for March 13th were 3.870 million versus 4.134 million the week prior. As a comparison, the weekly average of continuing claims for unemployment were 1.7 million prior to the COVID-induced escalation last year.

We end the first quarter of the year this week. The current consensus expectation for first quarter earnings is growth of 23.9% year-over-year and full-year 2021 earnings growth of 25.5%.

In our Dissecting Headlines section, we look at what’s going on in the Suez Canal.

Financial Market Update

Dissecting Headlines: The Suez Canal

The stuck ship in the Suez Canal has gone from an odd, one-off story to a short-term crisis for global shipping. The ship got wedged in the Canal on Tuesday and, as of Monday morning, has been partially refloated. Tugboats had initially been unable to free the ship and because of its position with the bow and stern anchored on the Canal’s shallows, the potential for a structural collapse in the middle of the hull had been a possibility.

The ship was en route from Malaysia to Rotterdam in the Netherlands. The Suez route reduces an Asia to Europe passage by around 5,000 miles. Resuming the route around Africa can add up to two-weeks to the journey.

The ship has been blocking the path of other vessels traveling in both directions across the Suez. Data from shipping Lloyd’s List said that over 160 vessels are waiting at either end of the canal, including 41 bulk carriers and 24 crude tankers. Even with the ship eventually getting through, it should take a while to clear the traffic jam. Other shipping was being rerouted around the Cape of Good Hope, adding time and expense to the journeys. Friday’s 4.2% increase in the price of Brent Crude (and 4.1% increase in West Texas Intermediate Crude) was attributed to the risk the Canal could be blocked for weeks. The added transit time reduces global shipping capacity. A.P. Moller–Maersk A/S, the world’s largest container vessel operator, said Sunday it had rerouted 15 of its ships away from the Suez Canal and is turning some new clients away as it assesses its capacity.

The Suez Canal transports 12% of global container trade and 10% of maritime oil shipments.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 29, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.