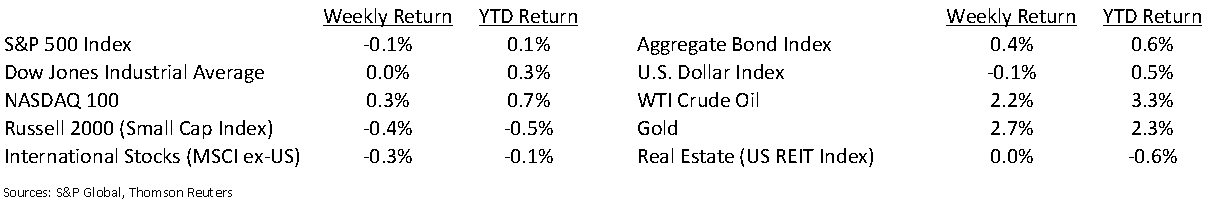

Momentum from year-end continued into the new year until U.S. – Iran tension reached a boiling point. The typical Middle East worry trade followed with oil, gold, Treasury bonds, bond proxies, and defense industry stocks to the positive in an otherwise down market.

The Federal Reserve released the minutes from its December meeting. The Fed indicated that it would not be raising short-term interest rates from the current 1.50% to 1.75% range as long as the economy remains on its current path.

We have mentioned that 2020 is likely to be a noisy year, mainly from the political arena heading into the U.S. Presidential election. Adding in some geopolitical tension to the mix could make it even noisier.

In our Dissecting Headlines section, we look at the January Effect what may cause some investors to believe the stock market should typically rise in January.

Financial Market Update

Dissecting Headlines: The January Effect

There is perception that the stock market typically rises in January. The “January Effect” has been positive 57 out of 92 times since 1928 (62%), so it is has been positive more often than not, but far from a sure thing.

Some factors that have been cited as reasons for the January Effect to happen are a reversal of tax-loss selling from December, reversal of money manager year-end “window dressing”, investment of bonuses, and resolutions to save and invest more.

We are not fans of market timing and believe consistent, long-term investing is the best way to build wealth. It is a marathon, not a sprint.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint January 6, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.