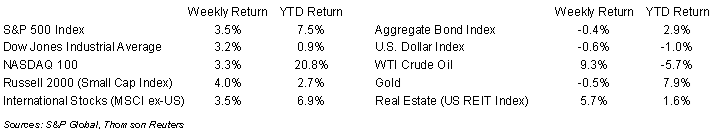

Earlier last month we mentioned March had come in like a lion. Then came the banking crisis. As the crisis began to resolve, investor confidence returned and March went out like a lion. The S&P 500 Index ended the last week of March +3.5%, the Dow was +3.2%, and the NASDAQ was +3.3%. The 10-year U.S. Treasury note yield increased to 3.490% at Friday’s close versus 3.378% the previous week.

Moderating inflation in the Personal Consumption Expenditures (PCE) Price Index for February along with a relative week of stability in the banking industry helped lend to investor confidence last week. The February PCE Price Index increased 0.3% month-to-month and core PCE, which excludes food and energy, also increased 0.3% month-to-month. These were each 0.1% below expectations. Year-over-year, PCE prices increased 5.0% and core PCE increased 4.6%. The Federal Reserve’s stated long-term target is core PCE of +2.0% annually. This week provides the next major economic data point with the March employment report scheduled for release on Friday.

First quarter earnings reporting starts in a few weeks. For the first quarter, the S&P 500 Index is expected to see an earnings decline of 5.0% on revenue growth of 1.6%. For full year 2023, S&P 500 Index earnings are expected to grow 1.2% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at the decision of several OPEC+ countries to cut oil production starting in May.

Financial Market Update

Dissecting Headlines: OPEC+ Cuts

Over the weekend, eight countries within OPEC+ announced they would cut oil production by a combined 1.16 million barrels per day from May until the end of the year. Saudi Arabia, the largest producer, announced a 500,000 barrel per day production cut. Other countries joining the production cut include Iran at 211,000 barrels per day, United Arab Emirates at 144,000, Kuwait at 128,000, Kazakhstan at 78,000, Algeria at 48,000, Oman at 40,000, and Gabon at 8,000.

The move likely increases oil prices globally and impacts U.S. drivers at the start of the traditional summer driving season and seasonal gasoline transition. Depending on the movement in the price of crude oil from the production cuts drivers could see up to a $0.25 per gallon increase in prices. Coupled with the higher cost of summer grade gasoline of approximately another $0.15 per gallon, gasoline prices could rise more than 10% higher than the current national average price of $3.506 for regular unleaded gasoline. At this time a year ago, prices were $4.192 per gallon, so there is a potential to return toward last year’s price levels.

A greater concern could be the pass-through of higher gasoline and diesel fuel prices through supply chains just as we have seen a slowing of the rate of inflation across many product and services categories.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 3, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.