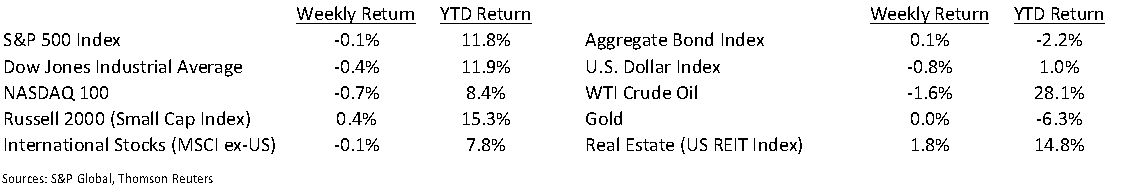

Despite generally positive corporate earnings reports, the equity markets were flattish last week on concerns surrounding proposals from the White House for higher capital gains taxes. Of the 123 companies in the S&P 500 Index that have reported earnings to date for Q1, 85.4% have reported earnings above analyst estimates. This compares to a long-term average of 65.3% and prior four quarter average of 75.5%. The Dow Jones Industrial Average closed the week –0.4%, the S&P 500 Index was –0.1% and the NASDAQ 100 Index was –0.7%. The U.S. 10-year Treasury bond yield declined to 1.567% at Friday’s close versus 1.573% the previous week.

We get over the hump this week with 180 companies in the S&P 500 Index scheduled to report earnings. First quarter earnings are expected to grow 33.9% year-over-year, an increase from last week’s expectation of 30.9% growth and 25.0% at the start of the quarterly reporting. Full-year 2021 earnings are expected to grow 29.3% year-over-year versus expectations of 27.9% growth last week and 26.5% at the start of the quarterly reporting.

Initial unemployment claims for the week of April 17th decreased to 547,000 versus the previous week at 586,000. Continuing claims for April 10th were 3.674 million versus 3.708 million the week prior. As we explain below, unemployment remains stickiest in the states with more COVID-19 restrictions.

In our Dissecting Headlines section, we provide an update on state-level unemployment data.

Financial Market Update

Dissecting Headlines: State-level Unemployment

The March Labor Department report showed the nationwide unemployment at 6.0%. Unemployment rates vary widely by state. The ten states with the lowest unemployment rates are Nebraska (2.9%), South Dakota (2.9%), Utah (2.9%), Vermont (2.9%), New Hampshire (3.0%), Idaho (3.2%), Iowa (3.7%), Kansas (3.7%), Alabama (3.8%), and Montana (3.8%).

The ten states with the highest unemployment rates are Hawaii (9.0%), New York (8.5%), New Mexico (8.3%), Connecticut (8.3%), California (8.3%), Nevada (8.1%), New Jersey (7.7%), Pennsylvania (7.3%), Louisiana (7.3%) and Rhode Island (7.1%).

The ten states with the highest unemployment rates all still have fairly stringent COVID-19 mandates as it relates to masking and capacity limitations. Nevada announced that casino capacity will be moving to 80% beginning May 1st and will move to 100% when 60% of adults are vaccinated. Meanwhile, California plans to reopen by June 15th assuming certain benchmarks are met.

The direction of employment from here likely mirrors the final reductions in COVID-related restrictions.

_________________

Want a printable version of this report? Click here: NovaPoint April 26th, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.