A good start to the fourth quarter earnings reporting season and the signing of the Phase One trade agreement between the U.S. and China combined to maintain positive equity market momentum this past week.

With 44 companies having reported fourth quarter earnings, 70% have exceeded expectations, 7% have reported in-line, and 23% have reported below expectations. Current consensus expectations are for a year/year earnings decline of -0.8% on revenue growth of +4.4% versus last week’s consensus for an earnings decline of -0.6% on revenue growth of +4.2%. Another 44 companies are scheduled to reporting earnings this week. Current consensus expectations for full-year 2020 earnings for the S&P 500 is currently +9.6% year/year with revenue growth of +12.2%.

In our Dissecting Headlines section, we highlight the major components of the Phase One trade agreement.

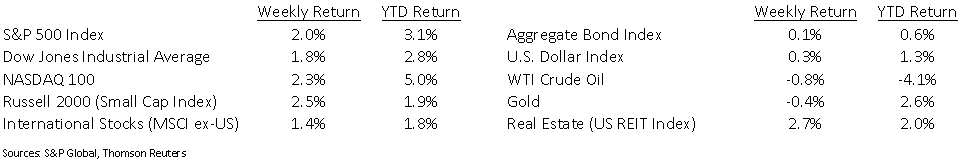

Financial Market Update

Dissecting Headlines: Phase One Trade Highlights

The Phase One trade agreement between the U.S. and China has been signed. It takes a significant step toward addressing some of the financial and legal imbalances that existed previously.

Tariffs: The U.S. suspended planned 15% tariffs that were scheduled to go into effect on Sunday on nearly $160 billion worth of Chinese goods and China canceled its retaliatory tariffs due to take effect that same day. The 15% tariff rate the U.S. imposed on September 1st on a $120 billion of Chinese goods will be halved to 7.5%. U.S. tariffs of 25% on $250 billion worth of Chinese goods will remain unchanged, providing negotiating leverage for a second phase of negotiations.

Purchases: China agreed to increase purchases of American products and services by at least $200 billion over the next two years. The purchases are expected to reduce the $419 billion U.S. trade deficit with China.

Intellectual Property: China offered greater legal protections for intellectual property. China also committed to follow through on previous pledges to eliminate any pressure for foreign companies to transfer technology to Chinese firms as a condition of market access.

Financial Market Access: U.S. companies should gain improved access to China’s financial services market to include banking, insurance, securities and credit rating services.

Further progress from here is likely dependent on compliance/enforcement and the ability to get started on Phase Two negotiations.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint January 20, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.