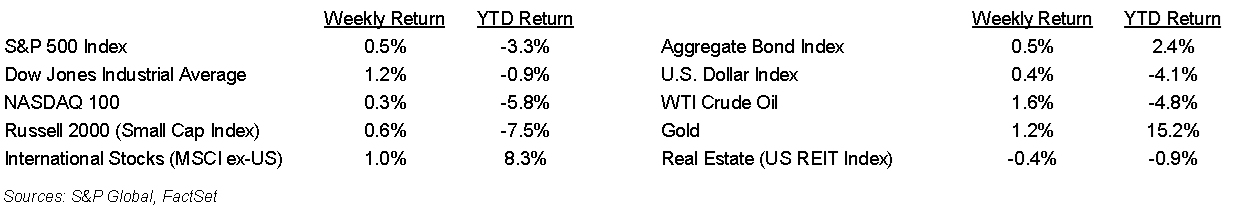

The S&P 500 Index finished the week higher to break its four-week losing streak. For the week, the S&P 500 Index was +0.5%, the Dow Jones Industrials +1.2%, and the NASDAQ +0.3%. The S&P 500 Index was led by the Energy, Financial, and Health Care sectors, while the Materials, Utility, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.250% at Friday’s close versus 4.316% the previous week.

The Federal Reserve held interest rates steady in the 4.25% to 4.50% target range at its Federal Open Market Committee (FOMC) meeting. The FOMC made some adjustments to its economic outlook but no changes to its policy path for interest rates. The FOMC still sees its year-end Fed funds rate target at 3.75% to 4.00%. The outcome of fiscal policy initiatives and resulting economic impact are needed for the FOMC to solidify a monetary policy path for 2025 and into 2026. CME Fed funds futures indicate there could be up to 0.75% in reductions to the Fed funds rate by December.

Four companies in the S&P 500 Index are scheduled to report first quarter earnings this week. First quarter 2025 earnings growth is currently forecast at 7.1% year-over-year with 4.2% revenue growth. Full-year 2025 earnings are expected to grow by 11.4% with revenue growth of 5.4%.

In our Dissecting Headlines section, we look at the updates to the Federal Reserve’s economic outlook.

Financial Market Update

Dissecting Headlines: Federal Reserve Outlook

The Federal Reserve’s Federal Open Market Committee (FOMC) kept the Fed funds rate steady at the 4.25% to 4.50% target range at its meeting last week. It indicated in the post-meeting statement that uncertainty around the economic outlook has increased. This is consistent with recent statements that several fiscal policy initiatives around tariffs and trade, immigration and border security, government spending reductions, and extension of tax cuts are creating near-term uncertainty.

The FOMC made some adjustments to its economic outlook with 2025 Gross Domestic Product (GDP) now projected at 1.7% versus 2.1% previously, year-end unemployment at 4.4% versus 4.3%, Personal Consumption Expenditures (PCE) inflation at 2.7% versus 2.5%, and core PCE at 2.8% versus 2.5%. The committee left its projected policy path unchanged at a year-end Fed funds target range of 3.75% to 4.00%, a 0.50% reduction from the current range.

The FOMC also announced a slowing to its balance sheet reduction starting in April by reducing its sale of Treasury securities from $25 billion per month to $5 billion per month and keeping its sale of agency securities at the current $35 billion per month.

In addition to updates on legislation to firm up a fiscal policy outlook, key data in the near-term includes the February PCE Price report on Friday, the March employment situation report on April 4th, and first quarter GDP on April 30th.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 24, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.