Despite a slew of strong company earnings reports, concerns about an accelerating spread of COVID-19 in both the U.S. and abroad pushed stocks lower last week. The Dow Jones Industrial Average declined 6.5%, the S&P 500 Index declined 5.6%, and the NASDAQ 100 Index declined 5.5%.

The earnings reporting season is rolling on and actual results are generally coming in ahead of expectations. The current third quarter consensus is for earnings to now be down 10.2% year-over-year (versus down 16.7% last week and down 21.7% at the start of earnings season) on a 2.9% decline in revenue. Of the 319 companies that have reported, 86.2% have reported earnings above consensus versus the long-term average of 65.1%, and 80.3% have reported revenue above consensus versus the long-term average of 60.3%. The current estimate for calendar 2020 earnings is -17.5% versus -18.5% last week and the estimate for calendar 2021 earnings is +24.9 versus +25.9% last week. The shrinking decline for 2020 is also causing a modest shrink in the relative gain predicted by analysts for 2021. This week, 129 additional companies in the S&P 500 are scheduled to report earnings.

The labor market continues to improve. Initial unemployment claims for the week of October 24th were 751,000 versus the previous week at 791,000. Continuing Claims for the week of October 17th were 7.756 million versus 8.465 million the week prior.

This should be another busy week with the election on Tuesday, the November Federal Reserve meeting on Wednesday and Thursday, and the October employment report on Friday.

In our Dissecting Headlines section, we follow-up on the third quarter GDP report.

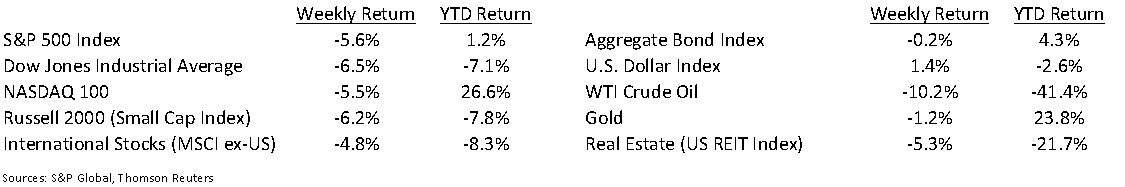

Financial Market Update

Dissecting Headlines: Third Quarter GDP Follow-Up

The first estimate for third quarter Gross Domestic Product (GDP) increased at an annual rate of 33.1% versus the 31.4% decrease in the second quarter. The total annualized size of the economy in the third quarter was $21.16 trillion versus $19.52 trillion in the second quarter. The data continues to get refined and the second estimate is scheduled for release on November 25th.

Personal consumption, private inventory investment, residential and nonresidential fixed investment, and exports all increased. Government spending declined partly due to lower Payroll Protection Program administrative fees and lower spending by state and local governments. Personal consumption was led by healthcare and food services, as well as spending on motor vehicles, clothing and footwear. Residential fixed investment was led by housing and nonresidential fixed investment was led by equipment purchases.

While we look at many discrete data points each week and month, the culmination in the size and growth of the economy can be measured quarterly with the GDP report.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint November 2, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.