All major U.S. equity indices were positive for the week. The Dow Jones Industrial Average was +1.9%, while the S&P 500 Index was +1.5% and the NASDAQ 100 Index was +1.0%. It was a dramatic headline week with the Presidential debate, September Employment Report, and the positive COVID tests for the President and First Lady.

The Labor Department reported that nonfarm payrolls increased by 661,000 in September. While this was lower than the consensus expectation for 750,000 net new jobs, it was a continued improvement in the economy which has now recovered half the jobs lost since the COVID induced lockdowns and business closures in the Spring. The August employment figures were also upwardly revised from 1.371 million jobs to 1.489 million. The unemployment rate fell to 7.9% in September from 8.4% in August.

The weekly employment data is also continuing to make positive strides. Initial unemployment claims for the week of September 26th were 837,000 versus the previous week at 873,000. Continuing Claims for the week of September 19th were 11.767 million versus 12.747 million the week prior. As we saw in the recent State-level unemployment data, most unemployed workers are in States with still high levels of lockdowns or other restricted activity (CA, NY, NJ, IL, etc.) or are tourist destinations such as Hawaii and Nevada.

Third quarter earnings reports kick into gear the week of October 12th. Current expectations are for third quarter earnings for the S&P 500 to be down 21.5% year-over-year versus the 30.6% decline for the second quarter. The current estimate for calendar year 2020 earnings is down 19.7% and the estimate for calendar year 2021 earnings is growth of 27.6%.

In our Dissecting Headlines section, we review the recent improvement in the Consumer Confidence Index.

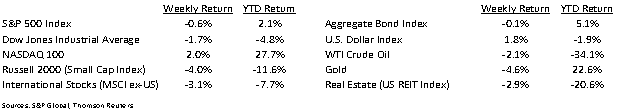

Financial Market Update

Dissecting Headlines: Consumer Confidence

One measure of the health of the U.S. consumer is the Consumer Confidence Index (CCI). This indicator published by The Conference Board measures the degree of optimism on the state of the U.S. economy that consumers are expressing through their activities of savings and spending. The CCI measures responses from approximately 5,000 consumers each month.

The Consumer Confidence Index for September increased to 101.8 versus 86.3 in August. This was the largest month-to-month gain in 17-years. The original August level had been 84.8 reported last month but was revised up to 86.3.

The Index is broken into two components, the Present Situation Index meaning how consumers feel about the current business and labor market conditions, and the Expectations Index meaning how they feel about how the next six months should go for their own income, business and labor. The Present Situations Index increased from 85.8 to 98.5 and the Expectations Index increased from 86.6 to 104.0.

These are the highest reading for the Index since the 120.0 level seen in March at the start of the COVID.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint October 5, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.