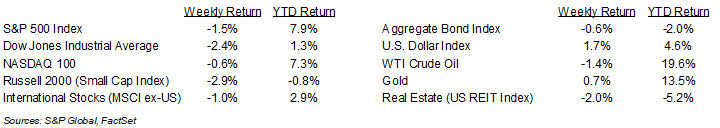

Stocks declined for a second consecutive week on concerns inflation is not receding. For the week, the S&P 500 Index was -1.5%, the Dow was -2.4%, and the NASDAQ was -0.6%. All eleven S&P 500 sectors declined with the Technology, Consumer Discretionary, and Consumer Staples sectors declining the least, and the Financials, Materials, and Health Care sectors declining the most. The 10-year U.S. Treasury note yield increased to 4.521% at Friday’s close versus 4.395% the previous week.

Higher than expected inflation was seen in the March Consumer Price Index (CPI) report. CPI was +0.4% month-over-month and +3.5% year-over-year. Core CPI, which excludes the impact of food and energy prices, was +0.4% month-over-month and +3.8% year-over-year. This data has pushed out market expectations from July to September for an initial rate cut by the Federal Reserve.

Key economic data points this week include the March Retail Sales and Housing Starts, but the greater focus at the outset of the week may be on geopolitical events in the Middle East.

The first quarter earnings reporting period ramps up further this week with 44 companies in the S&P 500 Index scheduled to report earnings. The current first quarter consensus forecast for the S&P 500 Index is 0.9% earnings growth with revenue growth of 3.4%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.3% with revenue growth of 4.8%.

In our Dissecting Headlines section, we look at what is driving automobile insurance prices higher.

Financial Market Update

Dissecting Headlines: Auto Insurance Prices

Most of the conversation about inflation has centered on large contributors to the overall inflation readings such as housing. One smaller component that has a significant inflationary impact on most Americans has been automobile insurance. Within the CPI Index, the price of auto insurance rose 2.6% in March and is 22.2% higher year-over-year. Vehicle insurance makes up 2.9% of the overall CPI basket of goods and services versus 36.2% for shelter (rent and owner’s equivalent rent for residences).

The 22.2% increase is the largest annual increase since 1976. Data from Bankrate shows that full coverage auto insurance costs an average of $193 per month and minimum coverage costs $54 per month. One factor cited for the higher cost of insurance is the higher cost of new and used vehicles. Vehicle prices rose sharply in 2021 with an 11.8% increase in new vehicles and a 37.3% increase in used vehicles. This was due to supply chain disruptions from the pandemic. The good news here is that prices for new and used vehicles has started to decline. New vehicle prices declined 0.2% month-to-month in March and used vehicle prices declined 1.1%. Year-over-year, new vehicle prices are 0.1% lower and used vehicle prices are 2.2% lower.

Another factor cited for higher insurance rates is an instance of higher fatalities as drivers have emerged from the pandemic. One more additional factor is higher cost for vehicle repairs due to higher labor costs for repairs. Increasing complexity of automobiles require more expensive repair parts and more expensive labor to make repairs. Higher labor costs across several special skill industries has been a stubborn, embedded factor in overall inflation.

While the cost of insurance, and overall inflation, remains high, consumer are getting some relief with year-over-year declines in several categories to include travel with airfare prices 7.1% lower and hotels 1.9% lower. Several housing-centric categories are also seeing year-over-year price declines to include appliances which have declined 6.3%, furniture 3.8% lower, and electronics 0.8% lower.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 15, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.