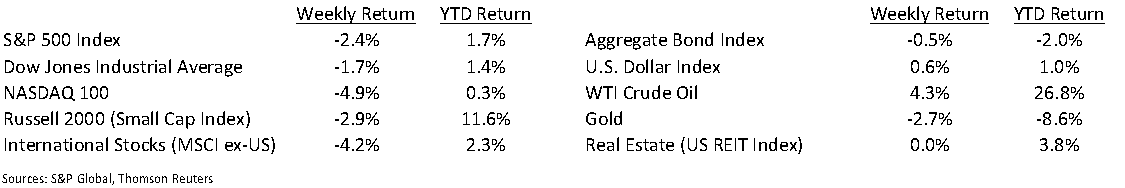

A sharply steepening yield curve pressured stocks last week. The Dow Jones Industrial Average was –1.7%, the S&P 500 Index was –2.4%, and the NASDAQ 100 Index was –4.9%.

We are nearing the end of the fourth quarter earnings season with 479 in the S&P 500 Index having reported earnings. Eighty percent of companies have reported earnings above consensus versus the long-term average of 65.3% and the past four quarter average of 75.5%. Fourth quarter earnings are expected to increase 4.3% year over year versus an expectation of +3.7% as of last week and a 10.6% decline when earnings reporting started. Quarterly revenue is expected to increase 1.6% year over year versus a 1.2% increase last week and a 1.4% decline at the start of the reporting season. This week, another 16 companies in the S&P 500 are scheduled to report earnings.

Year over year comparisons start to measure against the impact of COVID-19 in the latter part of the first quarter. First quarter 2021 earnings are expected to increase 21.6% and full-year 2021 earnings are expected to increase 23.4%.

Initial unemployment claims for the week of February 20th were 730,000 versus the previous week at 841,000. Continuing claims for February 13th were 4.419 million versus 4.520 million the week prior. We will get additional insight on the job market in the February Employment Report on Friday.

In our Dissecting Headlines section, we look at the National Retail Federation’s retail sales forecast for 2021.

Financial Market Update

Dissecting Headlines: Retail Sales Forecast

A combination of inability to travel, reduced dining out, and other impacts of the lockdowns that reduced spending has left many Americans with a build up of discretionary cash during COVID-19.

The National Retail Federation is forecasting that 2021 retail sales will grow between 6.5% to 8.2% to more than $4.33 trillion as more individuals get vaccinated and the economy reopens. This is on top of 2020 retail sales that grew 6.7% over 2019 to $4.06 trillion. Online sales, which are included in the total, are expected to grow between 18% to 23% to between $1.14 trillion and $1.19 trillion.

NRF’s forecast is predicated on a continued rollout of COVID vaccines and the U.S. economy reaccelerating job growth. As we’ve pointed out, much of the needed job growth is in states that have had stricter lockdown policies. The impact of the COVID vaccine to loosen restrictions in these states is a key factor to a full economic recovery.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 1, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.