Incremental social and economic activity continues across the globe. Some harder hit countries and specific areas of the United States will take longer to re-open, but the transition can be seen as restrictions on individuals and businesses in many areas continue to relax. Increased economic activity should follow.

For first quarter earnings, 275 companies in the S&P 500 have reported earnings through last week. Of those reporting, 68%have beaten reduced expectations and 29% have reported below. This week 156 companies in the S&P 500 are scheduled to report earnings. Current consensus is for earnings to be down 12.7% year over year, an improvement from last week’s expectation of -14.8%, and revenue is expected to increase 0.2% for the quarter versus last week’s expectation for a 0.3% decrease in revenue.

We continue to monitor employment as a key metric to gauge the potential economic impact from COVID-19. First-time unemployment claims for the week of April 25th decreased to 3.839 million versus 4.442 for the week of April 18th. The four-week moving average decreased to 5.033 million. Continuing Claims for the week of April 18th were 17.992 million, up from 15.818 million on April 11th. This is reported on a one week lag, so given the falloff in new claims, we may start to see continuing claims decrease as States continue to relax restrictions and businesses re-open.

In our Dissecting Headlines section we look at the Baltic Dry Index as a data point for monitoring global supply chain activity.

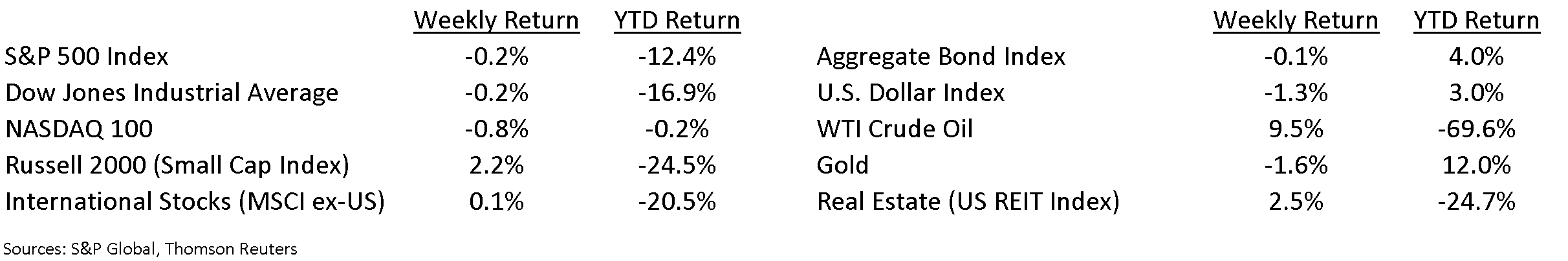

Financial Market Update

Dissecting Headlines: BDI and Global Supply Chain

After Richard Nixon’s visit to China in the early 1970’s, the US has been steadily moving manufacturing jobs to China and other southeast Asian countries as a means of reducing costs. After decades of moving manufacturing and assembly of various products to lower cost countries, we fast forward to early 2018 when President Trump initiated trade tariffs on Chinese manufactured products as a means of reducing the US trade deficit with China and increasing the number of American manufacturing jobs.

As the CVOID-19 pandemic hit, companies and countries alike have learned that managing a global supply chain is not always about getting the cheapest price or minimizing inventory with just-in-time delivery. Companies having to shut down their Chinese factories meant that a wide range of products were not going to be produced, keeping some consumer products from store shelves. Many countries also faced the harsh reality that the long list of offshore manufactured products also included hospital equipment such as Personal Protective Equipment and ventilators.

One data point that can help monitor the global supply chain is the Baltic Dry Index (BDI). The BDI measures multiple shipping rates across more than 20 routes for each of the BDI component vessels that carry sea-going freight, mainly raw materials. Rising or contracting index can be a leading indicator of future economic growth. The BDI appears to have bottomed the week of February 6th. We can continue to monitor this as one of many inputs to measure the pace of economic recovery.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint May 4, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.