Continued spread of the coronavirus (COVID-19) led stocks to the downside late last week. News of the virus also spreading outside of China to countries such as Italy has brought additional concern to investors trying to understand the potential economic impact of the outbreak. We view the issue as transitory. While the first quarter of 2020 is likely to see some negative financial impact, the outbreak should be contained at some point as we move into the spring.

We are headed into the tail-end of 4Q19 earnings with 437 companies in the S&P 500 Index having reported and another 41 reporting this week. Seventy percent have exceeded expectations, 10% have been in-line and 20% have been below expectations. Current consensus expectations are for year-over-year earnings growth of +3.2% on revenue growth of +5.1% versus last week’s consensus earnings growth of +2.6% on revenue growth of +5.1%. Current consensus expectations for full-year 2020 earnings for the S&P 500 is currently +8.3% year/year with revenue growth of +12.2%.

In our Dissecting Headlines section, we discuss how investors act in Risk On and Risk Off situations.

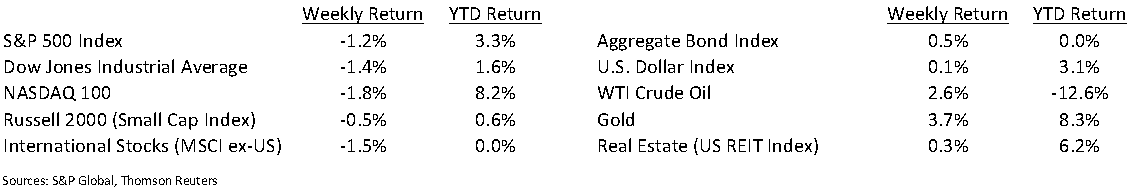

Financial Market Update

Dissecting Headlines: Risk On / Risk Off

Investing involves assuming risk in exchange for a return on assets invested. Riskier assets should earn a higher return and less risky assets should earn a lower return. When investors, as a group, are willing to take on more risk it is sometimes referred to as a “Risk On” environment. When geopolitical or economic uncertainties emerge, investors look to reduce risk and are willing to take a lower return. This is a “Risk Off” environment.

During a Risk On environment, more speculative equities such as cyclical, technology, small capitalization, and emerging market stocks can be in favor. During a Risk Off environment, U.S. Treasuries and other fixed income can be in favor, along with less volatile stocks such as consumer staples or utilities.

The U.S.—Iran skirmish from earlier this year and the current coronavirus outbreak are good examples of when investors move quickly to a Risk Off mode, but then can also quickly switch to a Risk On mode when there is evidence that the crisis situation is ending.

The investment markets can move very quickly, and very often, between Risk On and Risk Off. Often the perceived risk of the geopolitical or economic situation can be exaggerated and investors can sometimes get “whipsawed” if they chase these moves versus sticking with high-quality, well researched investments.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint February 24, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.