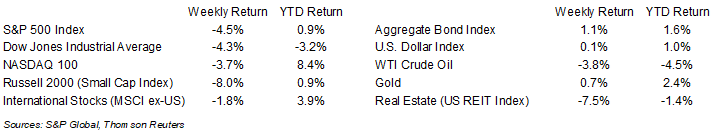

The equity markets fell sharply at the end of last week prompted by stability concerns in the banking sector after the closure of Silicon Valley Bank. The S&P 500 Index ended the week -4.5%, the Dow was -4.3%, and the NASDAQ was -3.7%. The 10-year U.S. Treasury note yield decreased to 3.695% at Friday’s close versus 3.963% the previous week.

The February employment report showed 311,000 new jobs created versus an expectation of 225,000. The unemployment rate increased to 3.6% from 3.4% in January. The employment report was one of two economic data sets that the Federal Open Market Committee (FOMC) likely needs to digest prior to its March 22nd meeting. The other is inflation data coming this week with the February Consumer Price Index (CPI) report on Tuesday and Producer Price Index (PPI) report on Wednesday. The additional system stress caused by the bank closures is also likely to be a component in the FOMC’s decision making.

Federal Reserve and Banking officials worked out a plan over the weekend to make depositors whole at both Silicon Valley Bank and Signature Bank, which was closed by regulators on Sunday.

In our Dissecting Headlines section, we look at recent issues in the banking sector and actions taken by the government to shore up the financial system.

Financial Market Update

Dissecting Headlines: Backstop Funding

Silicon Valley Bank was closed by regulators on Friday when it ran short on cash and was unable to secure additional funding. The bank was best known for being the bank of technology start-ups, and many early-stage companies maintained their excess cash there to funds operations and payroll. The Federal Reserve and Federal Deposit Insurance Corporation (FDIC), the agency that insures bank deposits up to $250,000, put together a plan over the weekend to shore up the financial system.

Signature Bank, another financial institution in the same situation as Silicon Valley Bank was closed by regulators on Sunday. The FDIC has said that customers will be made whole on all deposits at both banks, even those above the $250,000 FDIC insurance level. The Federal Reserve also announced the new Bank Term Funding Program (BTFP) which offers loans up to one year with a pledge of U.S. Treasuries, agency debt, mortgage-backed securities, and other qualifying assets as collateral. The BTFP will be an additional source of liquidity eliminating an institution’s need to sell securities in times of stress. The Fed’s discount window, the traditional method to provide liquidity to the financial system will still be available as well and financial institutions can obtain liquidity against a wide range of collateral.

These measures should clean up the issues at Silicon Valley Bank and Signature Bank. The post-mortem could prompt some further regulatory requirements on the banking system, especially institutions that deal directly with consumers and small businesses.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 13, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.