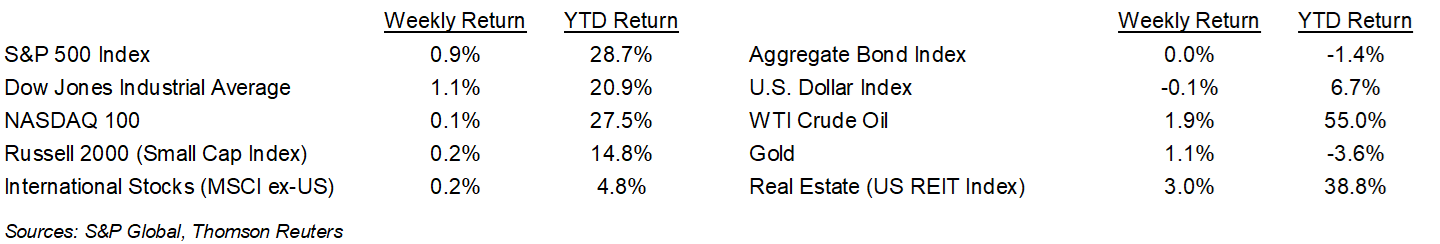

The U.S. equity markets closed out the year with a positive week. The S&P 500 Index was higher for the week by +0.9%, the Dow was +1.1%, and the NASDAQ was +0.1%. All three major U.S. indices closed the year with solid double-digit gains. Two particular asset class winners this year were oil and real estate, both of which were hard hit in 2021 by the economic impact of COVID but bounced back as the economy re-opened. The U.S. 10-year Treasury bond yield increased to 1.512% at Friday’s close versus 1.493% the previous week.

Looking ahead, fourth quarter 2021 earnings are expected to grow 22.3% on 12.0% revenue growth.

In our Dissecting Headlines section, we look at the base case for the economy and financial markets heading into 2022.

Financial Market Update

Dissecting Headlines: Setting the Stage for 2022

The backdrop for the economy and financial markets for 2022 is a Federal Reserve tightening posture with a tapering of monthly bond purchases projected to be complete by the end of the first quarter of the year. This should result in some upward pressure to intermediate term interest rates and initially steepen the yield curve. Once the taper is complete, the Fed has indicated it intends to increase the Fed funds target rate in three 0.25% increments over the balance of the year. Higher interest rates are a general indicator of economic growth and signal that the economy has moved forward from the economic shock in 2020 caused by the pandemic.

The Fed’s actions were laid out during the December Federal Open Market Committee Meeting. The 2022 economic scenario base case for the Fed’s actions are real Gross Domestic Product (GDP) growth of 3.6% to 4.5%, an unemployment rate of 3.4% to 3.7%, and Personal Consumption Expenditures (PCE) Inflation of 2.2% to 3.0%. We mention this base case because it helps us interpret potential changes in Fed policy over the course of the year by monitoring these economic data points.

We will start seeing fourth quarter earnings reports in a few weeks. The current expectation for the S&P 500 Index is 22.3% earnings growth year-over-year on 12.0% revenue growth. Factoring this in, full year 2021 earnings for the S&P 500 Index are expected to grow 49.7% on 16.6% revenue growth. The current forecast for full year 2022 is 8.4% earnings growth on 6.5% revenue growth. The 2022 forecast reflects a normalization after the earnings catch-up year in 2021 versus 2020, which was negatively impacted by the opening phases of the pandemic.

A new year can be cause for optimism. For stock market investors this is probabilistically true. Using the S&P 500 Index as a proxy, since 1926 the Index has produced a positive annual return 71-years out of that 96-year span, or 74% of the time. Still, we should expect volatility as the economy and financial markets adjust to a higher interest rate environment and uncertainty potentially unfolds as we head into the mid-term election cycle.

________________________________________

Want a printable version of this report? Click here: NovaPoint January 3, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.