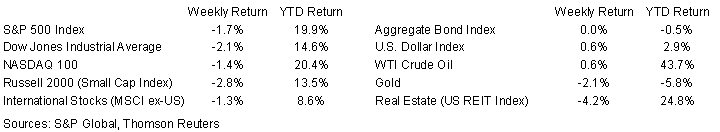

The equity markets had a slow leak over the short, four-day trading week last week. The S&P 500 Index closed the week –1.7%, the NASDAQ –1.4% and the Dow –2.1%. The U.S. 10-year Treasury bond yield increased to 1.343% at Friday’s close versus 1.326% the previous week.

With second quarter earnings reporting complete, the rest of September is likely to be dominated by political headlines surround infrastructure and budget bills, the debt ceiling, and the Sept 21-22nd Federal Reserve meeting. Looking ahead, the current forecast for third quarter earnings for the S&P 500 Index is +29.8% and fourth quarter earnings forecast is +21.8%.

Initial unemployment claims for the week of September 4th decreased to 310,000 versus the previous week at 345,000. Continuing claims for August 28th were 2.783 million versus 2.805 million the week prior. The below expectation August employment report should cause a sharp focus to remain on jobs as a gauge for potential Federal Reserve policy shifts.

In our Dissecting Headlines section, we look at the recent Federal Reserve Beige Book release.

Financial Market Update

Dissecting Headlines: Beige Book

Each of the twelve Federal Reserve Banks gather regional data on economic conditions that is released eight times a year in a report titled the “Commentary on Current Economic Conditions”, more commonly known as the “Beige Book”. The Beige Book provides granular information and anecdotes through interviews with business contacts, economists, market experts, and other sources. It is a qualitative report and meant to characterize current dynamics and identify emerging trends in the economy.

Last week’s Beige Book release indicated that economic activity decreased to a more moderate pace in July and August. Stronger sectors of the economy included manufacturing, transportation, nonfinancial services, and residential real estate. Activity slowed in dining out, travel, and tourism. This decline was attributed in most cases to impact of the COVID Delta variant.

Most districts reported labor shortages which constrained activity, as well as restrained sales of autos due to the chip shortage and home sales due to low inventories. Wages have been rising to attract workers and selling prices have been rising to pass along increased input costs.

However, most districts remained optimistic about near-term prospects, though concern about supply disruptions and resource shortages remain prevalent.

________________________________________

Want a printable version of this report? Click here: NovaPoint September 13, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.