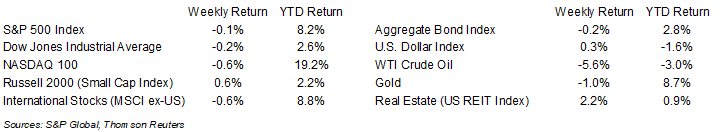

Despite the rush of individual company earnings reports, the equity markets stayed nearly flat for the week. The S&P 500 Index ended the week -0.1%, the Dow was -0.2%, and the NASDAQ was -0.6%. The 10-year U.S. Treasury note yield increased to 3.572% at Friday’s close versus 3.552% the previous week.

First quarter earnings reporting continues this week with 178 companies in the S&P 500 Index scheduled to report earnings. For the first quarter, the S&P 500 Index is expected to see earnings decline 4.7% on revenue growth of 1.9%. The outlook for the quarter has improved since the start of earnings season two weeks ago when consensus was a 5.2% earnings decline on revenue growth of 1.6%. Of the 88 companies that have reported so far, 76.1% have reported earnings above consensus. This is ahead of the long-term average of 66.3% and prior four quarter average of 73.5%.

For full year 2023, S&P 500 Index earnings are expected to grow 0.7% on revenue growth of 1.7%, a modest decline from two weeks ago when consensus was for 0.9% earnings growth for the year.

In our Dissecting Headlines section, we look at the difference between monetary policy and fiscal policy and how both may see impactful decisions in coming months.

Financial Market Update

Dissecting Headlines: Monetary Policy and Fiscal Policy

The Federal Reserve manages its part of the economy via monetary policy. This includes setting short-term interest rates and controlling the supply of money, or liquidity, in the economy. The Fed started raising short-term interest rates in early 2022 and is potentially nearing an end of that cycle of tightening economic conditions. The Fed is poised to increase the Fed funds rate by an additional 0.25% to a 5.00% to 5.25% range at its next meeting on May 3rd. Based on the impact of policy tightening to date and the impact of recent contraction in the banking industry, this could be the Fed’s last increase. Outside of a declarative statement at the May 3rd meeting, the Fed’s rate decision at the June 14th meeting coupled with the release of its quarterly summary of economic projections could end the tightening cycle. The current summary calls for the projected appropriate policy path to be a 5.00% to 5.25% Fed funds range.

The President, via the Department of Treasury, and Congress engage in fiscal policy. This includes tax and spending policy. With the U.S. up against its debt ceiling of $31.4 trillion, it needs Congress to approve an increase in the government’s borrowing capacity. House Speaker Kevin McCarthy announced a plan last week to raise the nation’s debt ceiling by $1.5 trillion in exchange for cutting government spending by $4.5 trillion over the next ten years. The $1.5 trillion increase proposed by McCarthy could cover the government’s borrowing needs until early next year. The plan was quickly dismissed by President Biden, but sets the stage for negotiations between now and June when it may become urgent to get the debt ceiling legislation approved.

Both monetary and fiscal policy could see significant decisions over the coming two months that impact the economy and investors.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 24, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.