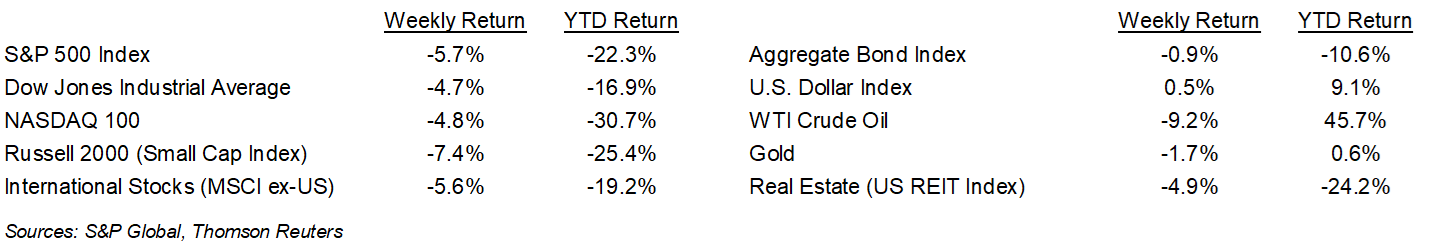

The S&P 500 Index fell again last week as the Federal Reserve continued to tighten monetary policy. The S&P 500 ended the week -5.7%, the Dow was -4.7%, and the NASDAQ was -4.8%. The 10-year U.S. Treasury note yield increased to 3.231% at Friday’s close versus 3.165% the previous week.

The Federal Open Market Committee raised the Fed funds target rate by 0.75% to a 1.50% to 1.75% range. Fed Chairman Jerome Powell also indicated a 0.50% to 0.75% increase would occur at the next meeting in July. Monetary policy is likely to continue to tighten until there are clear signs that the pace of inflation is cooling.

As we head into the end of the second quarter, the current consensus for second quarter earnings growth is 5.6% on 10.3% revenue growth. For the full-year 2022, earnings growth is currently forecast at 9.7% on 11.2% revenue growth.

In our Dissecting Headlines section, we review the recent FOMC meeting.

Financial Market Update

Dissecting Headlines: FOMC Meeting Review

The June Federal Open Market Committee (FOMC) raised the Fed funds target rate by 0.75% to a 1.50% to 1.75% range. The 0.75% increase in June was seeded into the financial news networks Monday afternoon and by early Wednesday, the futures had fully anticipated the 0.75% increase. Chairman Powell indicated in his post-meeting press conference that an increase of 0.50% or 0.75% is likely for the July meeting.

The updated Summary of Economic Projections from the June meeting indicated the median Fed funds target for the end of 2022 is 3.4%, translating to a 3.25% to 3.50% target range. This means the Fed is currently anticipating another 1.75% in short-term rate increases left for the year. We could map that over the remaining four meetings: July 0.75%, September 0.50%, November 0.25% and December 0.25%. This is one potential path and depends on how economic conditions evolve over the next few months. At the September meeting the FOMC will update its projections again.

The Summary also indicates 2022 GDP growth to be lower than anticipated in March (1.7% versus 2.8%) and that GDP growth is forecast to be below 2% for both 2023 and 2024. Unemployment is projected to increase to 3.7% in 2022, 3.9% for 2023, and 4.1% for 2024. These levels indicate a still very healthy labor market and we believe the Fed is willing to let the unemployment rate drift up as a consequence of bringing down inflation. On inflation, the Fed is currently projecting PCE inflation at 5.2% for 2022, 2.6% for 2023, and 2.2% for 2024.

The Fed has begun its balance sheet reduction with an expected trimming of $47.5 billion in June. Most of the reduction will be met with maturing securities that will not be reinvested. We should see reductions of $47.5 billion per month from June through August, and reductions of $95 billion per month from September to November. The Fed will likely adjust or announce the plan beyond November at some point over the next two FOMC meetings.

________________________________________

Want a printable version of this report? Click here: NovaPoint June 20, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.