Springing Forward! The equity markets moved to the upside last week. Investors seem to be a little more comfortable with bond yields. Two inflation measures for February, the CPI and PPI, showed an increase in inflation mainly tied to increasing energy prices. The February CPI showed 12-month rate of inflation for consumer goods and services at +1.7%. The PPI showed 12-month rate of inflation at +2.8%. The U.S. 10-year Treasury yield moved higher on the week to 1.635% at Friday’s close versus 1.554% the previous week.

Initial unemployment claims for the week of March 6th were 712,000 versus the previous week at 754,000. Continuing claims for February 27th were 4.114 million versus 4.459 million the week prior. As a comparison, the weekly average of continuing claims for unemployment were 1.7 million prior to the COVID-induced escalation.

With the first quarter of the year almost complete, we look forward to seeing company first quarter reporting beginning in early April. The current consensus expectation for first quarter earnings are grow of 22.3% year-over-year and full-year 2021 earnings growth of 24.3%. COVID-19 impacted many companies for part of the first quarter, then had a greater impact in the second quarter.

In our Dissecting Headlines section, we look at the Consumer Price Index as a gauge of inflation.

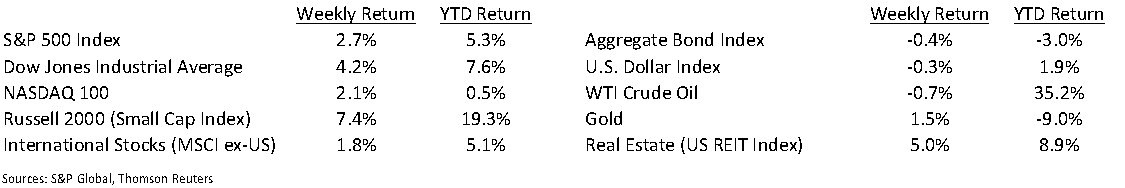

Financial Market Update

Dissecting Headlines: Consumer Price Index

Inflation is the increase in prices for a basket of goods and services in the economy. If the same basket of items costs 2% more this year than last year, then inflation is 2%. This is important because it means an average consumer needs 2% more money to purchase the same goods. This level of inflation that is experienced by consumers can be measured every month in the Consumer Price Index (CPI).

The Consumer Price Index (CPI) measures goods and services in eight categories: Housing, Food, Health Care, Recreation, Apparel, Transportation, Education/Communication, and Other Goods and Services. It is designed to measure prices across a broad basket that would effect most consumers, or what would be considered “retail inflation”.

The two headline numbers reported are CPI and CPI ex Food and Energy. Food and energy prices can be volatile month-to-month and removing these items measures “core inflation”. The February CPI report showed trailing twelve month increase of +1.7%. This was largely driven by an increase in food and energy prices. Excluding food and energy, consumer prices have increased 1.3% on a trailing twelve month basis.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 15, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.