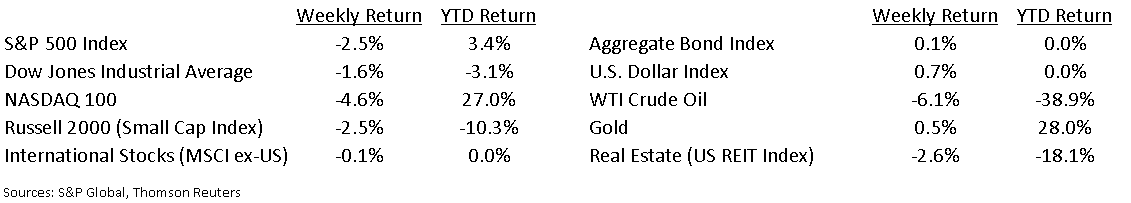

Stocks posted back-to-back down weeks despite reaching record highs near the start of September. The downside was felt more in the technology and growth-oriented sectors of the market. The S&P 500 Index has declined 4.55% since the beginning of September and the relatively higher technology weighted NASDAQ 100 Index ihas declined 8.45% over the same time frame.

The Federal Reserve’s Open Market Committee meets this coming Tuesday and Wednesday, with a policy statement scheduled for Wednesday afternoon. The Fed should keep rates steady and will likely provide supportive commentary. There is still slack in the labor market and low inflation, so the Fed should be willing to keep rates low and liquidity high until employment improves, even if it eventually triggers increasing inflation. This is consistent with its new average inflation targeting strategy that was recently announced. Importantly, this is the last scheduled meeting until after the November election.

The third quarter reporting season is still several weeks away. Current expectations are for third quarter earnings for the S&P 500 to be down 22.3% year-over-year versus the 30.2% decline for the recently completed second quarter. The current estimate for calendar year 2020 earnings is –19.8% and the estimate for calendar year 2021 earnings is +27.9%.

In our Dissecting Headlines section, we look at weekly gasoline demand and price data.

Financial Market Update

Dissecting Headlines: Gasoline Demand

Each week, the U.S. Energy Information Agency (EIA) releases supply and demand data on petroleum and other fuels. Most consumers are used to thinking about transportation fuels in terms of purchasing gasoline at the pump for their cars. The COVID combination of work from home and many other aspects of life being locked down earlier in the year reduced driving and the demand for gasoline. Prices also dropped, with the week-ending April 27th marking a multi-year low of $1.773/gallon.

If you have been to the gas station recently, you’ll see that prices have increased from their Spring lows. Average prices in the U.S. last week were $2.211/gallon. Prices are 13.3% lower than a year ago as demand has still not fully returned to normal. Current gasoline demand levels of 8.39 million barrels per day are 14.5% lower year over year. This is an improvement versus the 5.07 million daily barrels of demand seen during the peak of the lockdowns in April.

As the remaining areas of the country open up and consumers feel more comfortable venturing out for vacations, recreation, entertainment and other purposes, demand should eventually return to more normal levels.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint September 14, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.