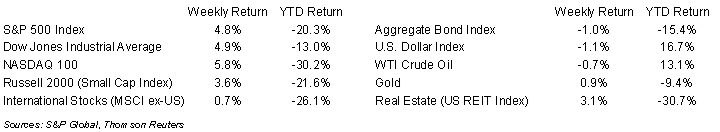

Stocks rallied on a combination of good earnings results and hope that the Fed would soon slow the pace of interest rate increases. The S&P 500 was +4.8%, the Dow was +4.9%, and the NASDAQ was +5.8%. The 10-year U.S. Treasury note yield increased to 4.212% at Friday’s close versus 4.006% the previous week.

Several Federal Reserve officials made reinforcing comments the Fed would raise rates by 0.75% at the next Federal Open Market Committee (FOMC) meeting scheduled for November 1st—2nd, but also expressed that the pace of tightening would likely slow over the next few months as progress is made in reducing the pace of inflation.

We reach the midway point in the third quarter earnings reporting season with 99 companies in the S&P 500 Index already reported and an additional 163 companies reporting earnings this week. The current consensus expectation is 3.1% earnings growth on 9.9% revenue growth. For CY2022 earnings growth is currently forecast at 6.9% on 11.4% revenue growth.

In our Dissecting Headlines section, we look at comments made by multiple Federal Reserve officials to gain some insight on where monetary policy goes.

Financial Market Update

Dissecting Headlines: Fed Speak

Several Federal Reserve officials were on the speaking circuit last week. Our take is the continues to aggressively increase interest rates to curb inflation, but that there is potential to slow the large increases in coming months.

Minneapolis Fed President Neel Kashkari (non-voting member) said he sees some signs that supply chains are getting better and that the more supply improves, the less the Fed has to raise rates. He also said it is possible that headline inflation has peaked, but core inflation has not. He sees no reason that the economy can’t get back to the 2.0% inflation level.

Philadelphia Fed President Patrick Harker (non-voting member) said the Fed is likely to raise interest rates to “well above” 4.0% this year and hold them at restrictive levels to combat inflation, while leaving the door open to doing more if needed. He sees the unemployment rate rising as high as 4.5% next year before falling to 4.0% in 2024. He sees the personal consumption expenditures (PCE) price index, the Fed’s preferred inflation metric, coming in at around 6.0% this year, 4.0% next year, and 2.5% in 2024.

San Francisco Fed President Mary Daly (non-voting member) sees Fed funds rate rising to 4.5% to 5.0%. In her judgement, more tightening is needed to move to restrictive territory, but the Fed needs to watch how restrictive and not over tighten. She thinks the Fed will need to step down into smaller rate hike increments.

St. Louis Fed President James Bullard (voting member) said the strong U.S. labor market gives the central bank room to raise interest rates so it can curb inflation that is running near a four-decade high and get inflation back to the 2.0% target “relatively quickly.”

The Fed should remain data dependent. The next key data point is the September PCE Price Index scheduled for this Friday.

________________________________________

Want a printable version of this report? Click here: NovaPoint October 24, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.