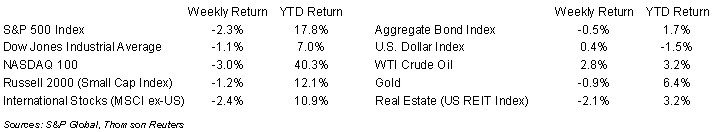

Temperatures remain warm but stocks have cooled recently with the S&P 500 Index’s first back-to-back weekly decline since early May. The weekly return for the S&P 500 Index was -0.3%, the Dow was +0.7%, and the NASDAQ was -1.3%. Within the S&P 500, the Energy, Healthcare, and Utility sectors led the market for the week, while the Technology, Consumer Discretionary, and Materials sectors lagged. The 10-year U.S. Treasury note yield increased to 4.168% at Friday’s close versus 4.062% the previous week.

Two key inflation reports were released last week. The July Consumer Price Index (CPI) showed consumer prices +0.2% month-to-month and core CPI (excluding food and energy prices) also +0.2% month-to-month. Year-over-year, CPI was +3.2% and core CPI was +4.7%. The July Producer Price Index showed wholesale prices +0.3% month-to-month and core PPI+0.2% month-to-month. Year-over-year, PPI was +0.8% and core PPI was +2.7%. Inflation continues to moderate on an annual comparison but remains above the Federal Reserve’s 2.0% target level.

We head into the last leg of the second quarter earnings period with several major retailers reporting this week. Overall, 456 companies in the S&P 500 Index have reported earnings and another 17 are scheduled for this week. Second quarter earnings expectation for the S&P 500 Index is a 3.8% year-over-year earnings decline on a revenue increase of 0.4%. Current consensus for full year 2023 earnings is an increase of 1.6% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at countries that make up the BRICS.

Financial Market Update

Dissecting Headlines: BRICS

The five BRICS countries: Brazil, Russia, India, China and South Africa are scheduled to hold the 15th BRICS summit on August 22-24th. One issue is the potential to create a combined reserve currency, backed by gold, to be used to settle international trade outside of the U.S. Dollar and Euro.

When combined, the five countries have a Gross Domestic Product (GDP) of approximately $27.7 trillion, just over 26% of global GDP and slightly larger than the United States alone at $26.9 trillion. China dominates the group with a GDP of $19.4 trillion, more than twice the size of the remaining four combined.

The idea of a gold-backed currency is certainly not new. Gold has been a medium of exchange and store of value for centuries. The U.S. Dollar had been tied to the price of gold for nearly its first two centuries in existence until it left the “gold standard” in 1971. As these emerging markets emerge (China is the second largest economy in the world and India is the fifth largest) there is likely a desire to unseat the economic powers of recent history in the U.S., Europe and Japan. Developing a global reserve currency to take the place of the U.S. Dollar is one aspirational step in that process.

China has been projecting its global economic influence through its Belt and Road initiative where it has engaged 149 countries in various infrastructure projects to include ports, airports, railways, highways, power stations, and telecommunications. The ability to attract and retain trade partners is a key to global economic ascendency.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly August 14, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.