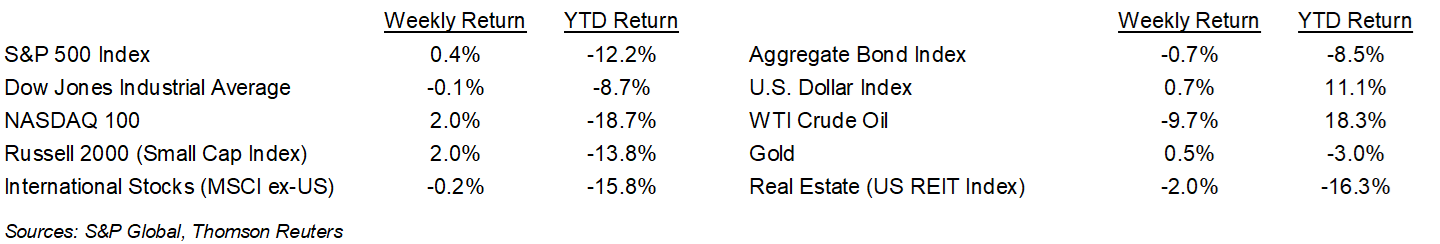

The S&P 500 Index had a third consecutive weekly increase, though more muted than the previous two weeks. The S&P 500 was 0.4% for the week, the Dow was -0.1%, and the NASDAQ was +2.0%. The 10-year U.S. Treasury note yield increased to 2.840% at Friday’s close versus 2.642% the previous week.

Continued strength in the labor market is providing the Federal Reserve enough support to continue tightening monetary policy. The July employment report showed an increase of 528,000 jobs and the unemployment rate declined to 3.5%. This week we return to the focus on inflation with the Consumer Price Index (CPI) and Producer Price Index (PPI) reports for July.

For the 432 companies in the S&P 500 Index that have reported earnings for the second quarter, 77.5% have exceeded consensus estimates. The current consensus for second quarter earnings growth is 9.2% on 13.4% revenue growth. This is an upward revision to last week’s consensus of 7.7% earnings growth on 12.1% revenue growth. For full-year 2022 earnings growth is currently forecasted at 8.1% on 11.5% revenue growth. This week 23 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at the July Employment Report.

Financial Market Update

Dissecting Headlines: July Employment Report

Despite slower economic growth and high inflation, one bright spot in the economy year-to-date has been the labor market. The employment report for July showed 528,000 net new jobs created. Job growth was led by Leisure and Hospitality with 96,000 new jobs, followed by Professional and Business Services with 89,000, and Health Care with 70,000. The unemployment rate is now 3.5%, back to its pre-pandemic levels.

Average hourly earnings rose by 0.5% to $32.27. Over the past 12 months, average hourly earnings have increased by 5.2%. While jobs have returned to their pre-pandemic level, the labor force participation rate of 62.1%, or the percentage of the working age population either working or looking for work, remains below its pre-pandemic level of 63.4%.

Strength in the labor market allows the Federal Reserve to continuing tightening monetary policy to reduce inflation. After the employment report was released, Federal Reserve governor Michelle Bowman commented that she supported similar sized rate increases (to the recent 0.75% increase) until inflation meaningfully declines. Between now and the Federal Reserve’s meeting on September 20th and 21st, we will have two months of CPI and PPI data (July and August), one month of Personal Consumption Expenditures (PCE) Price Index (July), as well as one more employment report (August) to help shape the Fed’s data-driven decision making on monetary policy.

________________________________________

Want a printable version of this report? Click here: NovaPoint August 8, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.