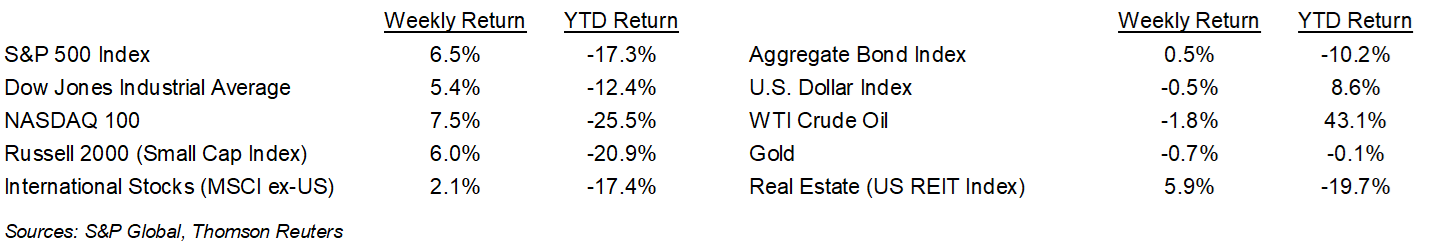

The S&P 500 Index rallied last week as investors became more comfortable with the Fed’s plan to stem the pace of inflation. The S&P 500 ended the week +6.5%, the Dow was +5.4%, and the NASDAQ was +7.5%. The 10-year U.S. Treasury note yield decreased to 3.138% at Friday’s close versus 3.231% the previous week.

Federal Reserve Chairman Jerome Powell completed his semi-annual economic testimony in front of Congress last week and reiterated the Fed’s plan to tighten monetary policy to tackle inflation. Several influential Fed members also commented last week that they were each individually leaning toward a 0.75% Fed funds rate increase for the July meeting (July 26-27th). This week, we get data on Personal Consumption Expenditures Prices (PCE Prices), which is the Fed’s preferred measurement on inflation. If it follows the steeper increase seen in the Consumer Price Index (CPI) earlier in the month, then the 0.75% rate increase for July looks likely.

As we head into the end of the second quarter, the current consensus for second quarter earnings growth is 5.8% on 10.5% revenue growth. Both the earnings and revenue growth expectations have inched up over the past few weeks. For CY2022, earnings growth is currently forecast at 9.7% on 11.3% revenue growth. In addition to impact of inflation on demand and input costs, headwinds from foreign currency translation may impact some companies with high foreign revenue exposure.

In our Dissecting Headlines section, we look at continued strength in Summer travel and the cost of a cookout.

Financial Market Update

Dissecting Headlines: Travel Demand and Cooking Out

The national average for retail gasoline prices is 58% higher year-over-year. This does not seem to be dampening consumers desire to travel this Summer. With the Independence Day holiday weekend on the way, the American Automobile Association (AAA) predicts 47.9 million people will travel 50 miles or more from home over the holiday weekend (June 30th to July 4th). This is an increase of 3.7% over 2021, bringing travel volumes almost to the levels seen in 2019. A coincident indicator is the TSA checkpoint data which showed 2.4 million people passed through TSA checkpoints last Friday, the highest level since prior to the onset of the COVID-19 pandemic.

In addition to gasoline, prices are higher across almost all travel input categories. The average lowest airfare is +14% year-over-year to $201 per ticket. Hotel rates are +23% year-over-year with the average lowest nightly rates coming in at $244 per night. One relative bright spot is car rental rates which have decreased 34% year-over-year with the average rate coming in at $110 per day, although this level is still $40 per day more than prior the pandemic.

For those staying home to cookout, the Farm Bureau estimates the average cost of a BBQ for four people is $76.94. This is 12.9% higher than in 2021. Most BBQ-centric categories are significantly higher year-over-year to include ground beef +16.8%, hot dogs +37.4%, chicken breasts +27.9%, and ice cream +14.1%.

________________________________________

Want a printable version of this report? Click here: NovaPoint June 27, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.