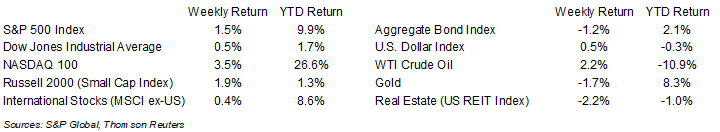

Markets ebbed and flowed with the progress of debt talks last week. S&P 500 Index ended the week +1.5%, the Dow was +0.5%, and the NASDAQ was +3.5%. The 10-year U.S. Treasury note yield increased to 3.692% at Friday’s close versus 3.463% the previous week.

House Speaker Kevin McCarthy is expected to meet with President Biden on Monday afternoon for more in-person discussions regarding the debt ceiling. The two had spoken by phone on Sunday as well. Treasury Secretary Janet Yellen has stated that June 1st is a likely deadline in order to keep the federal government current on all obligations.

The first quarter earnings season reporting period is almost complete. To date, 471 companies in the S&P 500 Index have reported first quarter earnings and an additional 15 companies scheduled for this week. For the first quarter, the S&P 500 Index is expected to see earnings decline 0.2% on revenue growth of 3.6%. The outlook for the quarter has improved since the start of earnings season several weeks ago when consensus was a 5.2% earnings decline on revenue growth of 1.6%. For full year 2023, S&P 500 Index earnings are expected to grow 1.2% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at the progress on the debt ceiling negotiations.

Financial Market Update

Dissecting Headlines: Debt Ceiling Negotiations

Debt ceiling negotiations initially stalled Friday afternoon causing the equity markets to close modestly lower on the day. Negotiations resumed on Saturday and House Speaker McCarthy and President Biden spoke by phone on Sunday. While there is still no agreement, both sides expressed optimism after the call and the two are expected to meet on Monday afternoon.

While we think a deal ultimately gets done prior to any critical payment issues by the federal government, this is a politically charged negotiation because of the divided government. The Republican-led Congress is seeking lower levels of spending with discretionary spending returning to 2022 levels and capped at one-percent growth annually. They are also seeking to claw back unused COVID relief funds, repeal most of the energy and climate tax credits from the Inflation Reduction Act, as well as the increased IRS enforcement spending. The Democrat-led White House wants to increase the corporate income tax rate to 28% from 21% currently and increase taxes on high income earners.

As the deadline draws near, both sides will likely need to give in on some of their proposal points. A poll conducted by AP-NORC Center for Public Affairs Research showed 63% of Americans polled want increases in the debt ceiling to be coupled with agreed upon terms for reducing the federal budget deficit. With an important election cycle coming in 2024, neither side wants to be blamed for any failure on the debt ceiling or economy.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 22, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.