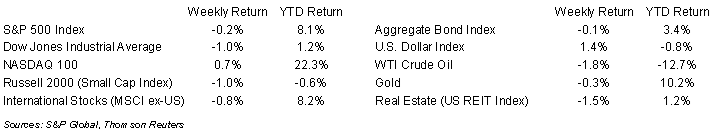

The S&P 500 Index ended the week -0.2%, the Dow was -1.0%, and the NASDAQ was +0.7%. The 10-year U.S. Treasury note yield increased to 3.463% at Friday’s close versus 3.446% the previous week. Debt ceiling discussions continue, and some optimism has been expressed by the White House that a deal can be reached.

The April Consumer Price Index (CPI) showed levels of core inflation still above the Federal Reserve’s target of a 2.0% annual rate, but year-over-year comparisons continue to improve. For April, the CPI was +0.4% month-to-month and core CPI, which excludes food and energy, was also +0.4% month-to-month. On a year-over-year basis, CPI is +4.9% and core CPI is +5.5%.

Several major retail companies report earnings this week and should provide some insight on the state of the consumer. To date, 457 companies in the S&P 500 Index have reported first quarter earnings and an additional 15 companies scheduled for this week. For the first quarter, the S&P 500 Index is expected to see earnings decline 0.6% on revenue growth of 3.5%. The outlook for the quarter has improved since the start of earnings season several weeks ago when consensus was a 5.2% earnings decline on revenue growth of 1.6%. Of the 457 companies that have reported so far, 76.6% have reported earnings above consensus. For full year 2023, S&P 500 Index earnings are expected to grow 1.2% on revenue growth of 1.7%.

In our Dissecting Headlines section, we look at the start of the summer travel season.

Financial Market Update

Dissecting Headlines: Memorial Day Travel

Despite persistent inflation, Americans are planning to live their best life this summer. For the upcoming Memorial Day Weekend, May 26th to 29th, the Automobile Club of America (AAA) forecasts 42.3 million Americans will travel more than 50 miles from their homes. This is a 7.0% increase year-over-year and within one-percent of the 42.8 million that traveled Memorial Day Weekend 2019.

Auto travel is the most prevalent, with 37.1 Americans expected to travel by car, a 6.0% increase year-over-year. The average price for regular gasoline is $3.535 per gallon, down 20.9% from last year. While core consumer prices have continued to rise, the falloff in gasoline prices can ease the burden of both car travel and other expenses. The U.S. Travel Association data shows lodging prices are 3.5% higher year-over-year, food and beverage prices are 8.4% higher, and recreation expenses are 5.8% higher.

Post-pandemic airline travel continues to be popular even though ticket prices remain high. Airlines should carry 3.39 million travelers for the holiday weekend, an 11% year-over-year increase. This also exceeds the 2019 level by 5.4%. Other modes of travel, to include trains and buses, are expected to carry 1.85 million passengers, an increase of 20.6% year-over-year.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 15, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.