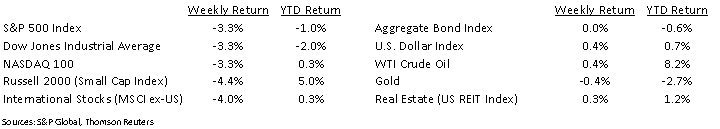

The financial headlines were packed last week with earnings results, short squeezes, and vaccine news. The end results left all major U.S. market averages in the red for the week. The Dow Jones Industrial Average, S&P 500 Index, and NASDAQ 100 Index were all down 3.3%.

We are almost halfway through the fourth quarter earnings reporting cycle. Of the 184 companies in the S&P 500 that have reported quarter-to-date, 84.2% have reported earnings above consensus. This week, another 112 companies in the S&P 500 are scheduled to report earnings. Fourth quarter earnings are expected to decline 1.6% year-over-year, an improvement from the expectation of a 5.7% decline last week. Strong earnings reports from several large companies have helped narrow the expected decline. Revenue for the quarter is now expected to grow 0.2% year-over-year, a switch from an anticipated decline previously. Full-year 2020 earnings are expected to decline 13.1% year-over-year and full-year 2021 earnings are expected to rise 23.7% year-over-year.

Initial unemployment claims during the week of January 23rd declined to 847,000 versus 914,000 the previous week. Continuing claims for the week of January 16th were 4.771 million versus 4.974 million the week prior. Unemployment has been higher in tourist destination States like Hawaii and Nevada, as well as States that have had tighter lockdown and business restrictions such as California and New York. We will see additional data when the January Employment Report is released this coming Friday.

In our Dissecting Headlines section, we look at what a short squeeze is.

Financial Market Update

Dissecting Headlines: Short Squeeze

Short selling is when an investor borrows shares of a stock to sell, hoping to buy it back for a lower price to profit from the downward price movement. When a stock that has a high short interest, meaning a large number of investors have borrowed and sold shares they do not own, starts to rally, it can cause a short squeeze.

The sharply increasing price of the stock can force the short sellers (those who have borrowed and sold the stock) to scramble to buy the stock back in order to stem losses of the stock moving in the wrong direction for them. The competition to buy shares of the shorted stock by both those trying to cover their short positions as well as buyers trying to profit from the short squeeze can exacerbate the price movement of the stock.

The trigger for the short squeeze can be any type of news such as unexpectedly good earnings, an announced acquisition of the shorted company, a new management team, or other positive changes. In the cases we saw in the market last week, it was the coordinated effort of traders to trigger a short squeeze without news and force short sellers to capitulate on their positions.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint February 1, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.