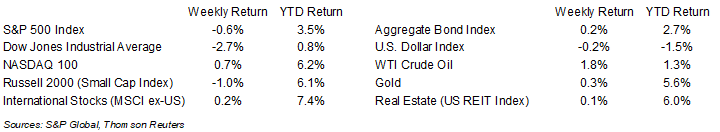

Equity markets were mixed last week. The S&P 500 was -0.6%, the Dow was -2.7%, and the NASDAQ was +0.7%. The 10-year U.S. Treasury note yield decreased to 3.484% at Friday’s close versus 3.511% the previous week.

The December Producer Price Index (PPI) was -0.5% month-to-month and core PPI (which excludes food, energy, and trade) was +0.1% month-to-month. Year-over-year, PPI was +6.2% and core PPI was +4.6%. Both Food and Energy have trended in a less inflationary direction, similar to the CPI report. The December Personal Consumption Expenditures (PCE) Price Index is scheduled for release on Friday. This is the Federal Reserve’s preferred inflation indicator, and the year-over-year core data is important to understanding the Fed’s leanings heading into the FOMC meeting on Jan 31st / Feb 1st.

Earnings reports start ramping up this week with 88 companies in the S&P 500 Index scheduled to report earnings. The current consensus for fourth quarter earnings for the S&P 500 Index is a 2.9% decline in year-over-year earnings on 4.1% revenue growth. For full-year 2022, current consensus is 5.3% year-over-year earnings growth on 11.2% revenue growth. The early look for full-year 2023 is a consensus expectation of 3.5% earnings growth on 2.1% revenue growth.

In our Dissecting Headlines section, we look at the January Effect in the stock market.

Financial Market Update

Dissecting Headlines: January Effect

With the S&P 500 Index +3.5% year-to-date and the Russell 2000 Index of small cap stocks +6.1%, this month is shaping up as a good example of the January Effect. This seasonal market trend states that the stock market tends to trade higher in January and that small cap stocks typically outperform large cap stocks. From a market return basis, the effect holds up with historical returns of 1.1% for the S&P 500 Index and closer to 2.0% returns for the Russell 2000 Index.

Several causes are typically cited for the January Effect. First, when tax loss selling occurs in December, there is a possibility that those stocks are repurchased in January after the losses have been harvested. Second, some individuals may receive year-end bonuses or profit sharing contributions that are invested in January, adding to buying demand. Third, at the beginning of the year, institutional investors and fund managers are more prone to take risks, knowing they have time to make corrections if those risks don’t pan out. This can especially be the case with riskier, less liquid small cap stocks. It can also be the case if those managers sold risky investments in December as a part of year-end “window dressing”.

Given the steep market decline in 2022, conditions typically cited for the January Effect, especially among some beaten-down stocks in the Russell 2000 and NASDAQ, were in place to fulfill the January Effect here in early 2023.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 23, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.