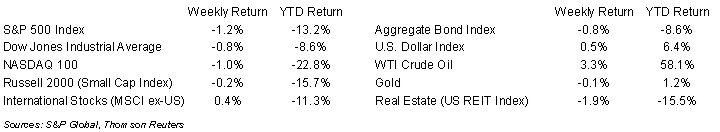

The S&P 500 Index had a small relapse last week after its big advance the week prior. The S&P 500 ended the week -1.2%, the Dow was -0.8%, and the NASDAQ was -1.0%. The 10-year U.S. Treasury note yield increased to 2.941% at Friday’s close versus 2.743% the previous week.

As reflected in the May employment report, job growth remained strong, thus likely keeping the Federal Reserve on track to continue raising interest rates. May nonfarm payrolls were +390,000 versus an expectation of +325,000. The unemployment rate held steady at 3.6%. The leisure and hospitality industry continued to lead job growth this year, adding 84,000 jobs in May. Professional and business services added 75,000 jobs, transportation and warehousing added 47,000 jobs, education and health services added 74,000 jobs, construction added 36,000 jobs, and the government added 57,000 jobs. The motor vehicle industry and retail industries shed jobs during the month. We believe job growth should slow in coming months as the Federal Reserve’s focus on stemming inflation may cause some economic slowing, prompting companies to pause hiring. This has already occurred in some companies in the technology sector.

With the first quarter earnings reporting period almost complete, the current consensus for 1Q22 is 11.3% earnings growth on 13.9% revenue growth versus 6.1% earnings growth on 10.9% revenue growth at the start of the earnings season. For the 495 companies in the S&P 500 that have already reported first quarter earnings, 77.4% have reported earnings above analyst estimates. This coming week three companies in the S&P 500 Index are scheduled to report earnings. Looking ahead, the current consensus for 2Q22 earnings growth is 5.3%, with CY2022 earnings growth forecasted at 9.4%.

In our Dissecting Headlines section, we look at the Federal Reserve’s quantitative tightening program.

Financial Market Update

Dissecting Headlines: Quantitative Tightening

Quantitative tightening is a contractionary monetary policy tool designed to decrease the amount of liquidity in the economy. The Federal Reserve can induce quantitative tightening by selling off assets on its balance sheet into the financial markets. This can also partially be accomplished by letting fixed income securities mature and not reinvesting the proceeds.

The Federal Reserve is beginning its quantitative tightening program this month. For the next three months, June through August, the Federal Reserve will reduce its balance sheet by $47.5 billion per month. It will sell, or let mature, $30 billion of Treasury securities and $17.5 billion of mortgage securities each month. Starting in September, the monthly amount is planned to increase to $95 billion, composed of $60 billion of Treasury securities and $35 billion of mortgage securities.

During the COVID-19 pandemic, the Federal Reserve expanded its balance sheet from $4.2 trillion to $8.9 trillion to provide liquidity in the financial markets and help the government fund various programs to support the economy. The Fed is now reversing that quantitative easing policy to both fight inflation and reduce its balance sheet risk. Given the magnitude of the quantitative easing during COVID, the duration of the quantitative tightening cycle could last several years at a $95 billion per month rate.

________________________________________

Want a printable version of this report? Click here: NovaPoint June 6, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.