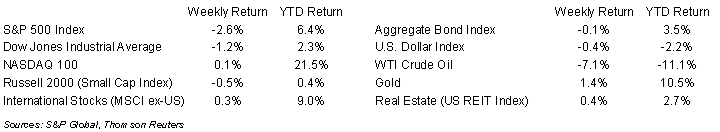

The S&P 500 Index ended the week -2.6%, the Dow was -1.2%, and the NASDAQ was +0.1%. The 10-year U.S. Treasury note yield decreased to 3.446% at Friday’s close versus 3.452% the previous week.

As expected, the Federal Reserve raised the Fed funds rate by 0.25% to a 5.00% to 5.25% range. It left future policy open and data dependent. April’s employment report showed 253,000 net new jobs created versus an expectation of 180,000. The unemployment rate was 3.4%. Hourly wages rose 0.5% month-to-month and 4.4% year-over-year.

Leadership from the House and Senate are scheduled to attend a meeting with the President on Tuesday to discuss the looming debt ceiling. The House has passed a debt ceiling resolution with multiple spending cuts attached. The White House has been dismissive so far but is likely trying to negotiate a solution with help from the Senate.

We are on the downslope of the first quarter earnings reporting with 419 companies in the S&P 500 Index complete and an additional 31 companies scheduled for this week. For the first quarter, the S&P 500 Index is expected to see earnings decline 0.7% on revenue growth of 3.5%. The outlook for the quarter has improved since the start of earnings season three weeks ago when consensus was a 5.2% earnings decline on revenue growth of 1.6%. Of the 419 companies that have reported so far, 77.1% have reported earnings above consensus. For full year 2023, S&P 500 Index earnings are expected to grow 1.5% on revenue growth of 2.0%.

In our Dissecting Headlines section, we look at the debt ceiling and upcoming meeting between Congressional leaders and the President.

Financial Market Update

Dissecting Headlines: Debt Ceiling

The United States’ debt ceiling is the maximum amount of money the government can borrow. The debt ceiling was initially created to limit borrowing under the Second Liberty Bond Act in 1917 at $11.5 billion. In 1939, Congress removed various separate debt limits and replaced it with a total limit of $65 billion. The current debt ceiling is $31.4 trillion and Treasury Secretary Janet Yellen recently warned that the ceiling needs to be raised by June in order to avoid a debt default. The House of Representatives passed a bill called the Limit, Save, Grow Act at the end of April to approve a $1.5 trillion increase in the debt or through March 2024, whichever comes first. In exchange for this increase in borrowing authorization, the bill calls for caps on spending. This was initially dismissed by the White House, which stated the debt ceiling needed to be increased with no conditions.

This week, the leadership from Congress (House Speaker McCarthy, Democratic House Leader Jeffries, Senate Majority Leader Schumer, and Minority Leader McConnell) is scheduled to meet with President Biden at the White House to discuss the stand-off. To raise the debt ceiling, both houses of Congress need to pass a bill, and the President needs to sign it. The recently passed House bill likely does not have enough support in the Senate. This should come down to a negotiation where the debt ceiling is raised, but with some of the spending reductions in the House bill. As time moves closer to the U.S. facing payment obligations higher than revenues, the need to find a solution becomes more urgent. Unfortunately, the politicians are likely to try and extract every measure of publicity benefit. While the debt ceiling has been raised many times without fanfare, this could drag out into the final days or hours as it did in 2011. Stay tuned.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 8, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.