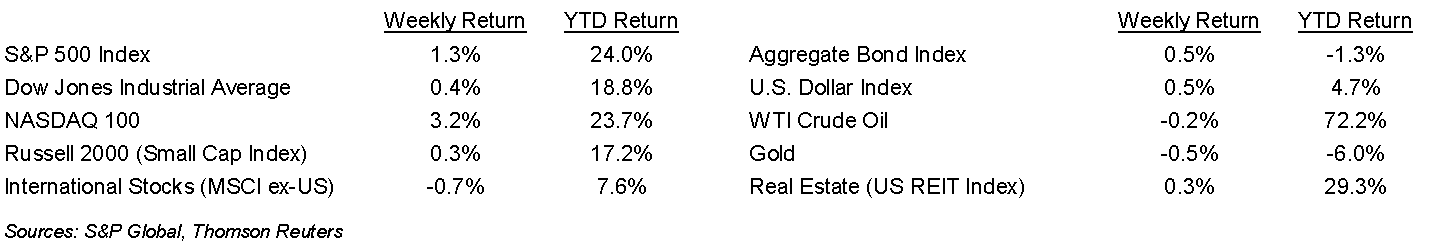

All four weeks in October were positive in the equity markets. This past week, the S&P 500 was +1.3%, the Dow was +0.4% and the NASDAQ was +3.2%. Oil snapped its multi-week rally, finishing down 0.2%. The U.S. 10-year Treasury bond yield decreased to 1.554% at Friday’s close versus 1.653% the previous week.

Current forecast for the S&P 500 Index is for Third Quarter earnings growth to be +39.2% year-over-year versus an expectation of +34.8% last week. At the outset of the earnings season in early October, the Third Quarter year-over-year growth was expected to be 29.4%. This week 169 companies in the S&P 500 are scheduled to report earnings. Quarter-to-date, 82.1% of companies have reported earnings above analyst estimates. This compares to a long-term average of 65.8% and prior four quarter average of 84.7%. We heard similar commentary as last week with logistic issues, product shortages, and the impacts of inflation detracting from quarterly performance among some companies.

The major event for the week is the Federal Open Market Committee (FOMC) meeting on Wednesday. It is largely expected the FOMC will announce a start to the tapering of monthly bond purchases.

Initial unemployment claims for the week of October 23rd decreased to 281,000 versus the previous week at 291,000. Continuing claims for October 16th were 2.243 million versus 2.480 million the week prior. The October employment report is also scheduled for release on Friday.

In our Dissecting Headlines section, we look at predictions for the upcoming holiday shopping season.

Financial Market Update

Dissecting Headlines: Holiday Shopping

It is 54 days until Christmas. The National Retail Federation (NRF) is forecasting holiday sales during November and December will grow between 8.5% and 10.5% over 2020 to between $843.4 billion and $859.0 billion. October retail sales data is schedule for release in mid-November and that could shed light on whether potential product shortages are prompting consumers to start their holiday shopping earlier.

With reduced pandemic concerns in many areas of the country, households are expected to shift back to in-store shopping and a more traditional holiday shopping experience. Online sales should also see strong growth. NRF expects that online and other non-store sales, which are included in the total, will increase between 11% and 15% to a total of between $218.3 billion and $226.2 billion (approx. 26% of total sales) driven by online purchases.

Temporary hiring should also be higher this year. NRF expects retailers will hire between 500,000 and 665,000 seasonal workers versus 486,000 seasonal hires in 2020. Some of this hiring may have been pulled into October as many retailers encouraged households to shop early to avoid a lack of inventory and shipping delays. With the earlier start, retailers have announced thousands of open positions in bricks-and-mortar stores and warehouse and distribution centers. This opportunity could result in some unemployed individuals seeking temporary work rather than commit to a full-time position, if they are undecided about when and where to re-enter the job force on a permanent basis.

________________________________________

Want a printable version of this report? Click here: NovaPoint November 1, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.