Optimism on U.S.—China trade helped markets extend gains for the third straight week. Stocks are at record levels as the third quarter earnings season slows into its final weeks. Of the 446 companies in the S&P 500 that have reported 3Q earnings, 74% have exceeded expectations, 7% have met expectations and 19% have reported below expectations. Current expectation is for a 0.5% decline in year/year earnings on 3.9% revenue growth versus last week’s consensus of a 0.8% earnings decline on a 3.7% increase in revenue. Excluding the Energy sector, earnings are expected to grow 2.1% y/y. For the coming week, 16 companies in the S&P 500 are scheduled to report earnings.

Aside from earnings reports, there are several inflation focused data points in the coming week. The Consumer Price Index, which measured retail inflation, and the Producer Price Index, which measures wholesale inflation, for October will be released. October retail sales will also be released this week. Consumer spending has been a bright spot for the economy all year and will be important heading into the holiday spending season.

In our Dissecting Headlines section, we’ll explain two measures of the health of the consumer: the Consumer Confidence and University of Michigan Consumer Sentiment Indices.

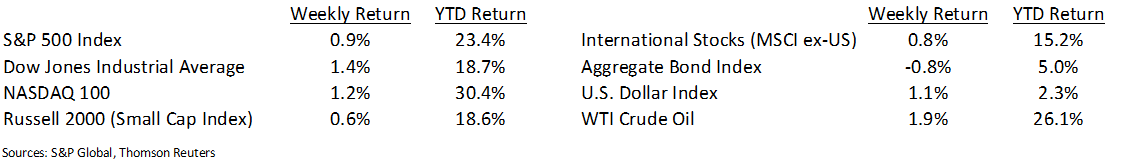

Financial Market Update

Dissecting Headlines: Consumer Confidence and Consumer Sentiment

One measure of the health of the U.S. consumer is the Consumer Confidence Index (CCI). This indicator published by The Conference Board measures the degree of optimism on the state of the U.S. economy that consumers are expressing through their activities of savings and spending. The CCI measures responses from approximately 5,000 consumers each month. A second measure of consumer health is the University of Michigan Consumer Sentiment Index (MCSI) which surveys approximately 500 consumers, but asks more detailed questions. While similar in purpose, the results of these two surveys can differ from month-to-month, but show a correlated picture over longer time periods.

The October CCI decreased marginally in October to a reading of 125.9 versus 126.3 in September. The Present Situation Index (based on assessment of current business and labor market conditions) increased to 172.3 versus 170.6 and the Expectations Index (based on consumers’ short-term outlook for income, business and labor market conditions) declined to 94.9 versus 96.8.

Released on Friday, the preliminary MCSI for November rose to 95.7 versus 95.5 in October. Sentiment on current conditions declined to 110.9 in November versus 113.2 in October while expectations rose to 85.9 in November from 84.2 in October.

Both Indices are important to monitor, along with consumer spending and retail sales, as we head into the important holiday shopping season. The final November MCSI is scheduled for November 22nd and the November CCI is scheduled for November 26th.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint November 11, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.