The stock market finished the week higher and hit all-time highs after a US-China trade deal was agreed upon. The agreement, known as a phase-one deal, averted new tariffs on $160 Billion of consumer goods set to start on December 15th. The agreement also reduced some current tariffs, with China agreeing to increase purchases of U.S. farm products over two years.

At its last meeting of the year, the Federal Reserve held short-term interest rates steady with a target range of 1.50% to 1.75%, and indicated that it does not currently see any need for rate increases in 2020. Inflation is well contained and the job market and consumer spending are healthy.

The week ahead will be geopolitical and macroeconomic focused with more details likely to come on the U.S.—China trade agreement, as well as the USMCA trade agreement and government funding.

In our Dissecting Headlines section, we explain some of the key points in the United States-Mexico-Canada Agreement (USMCA).

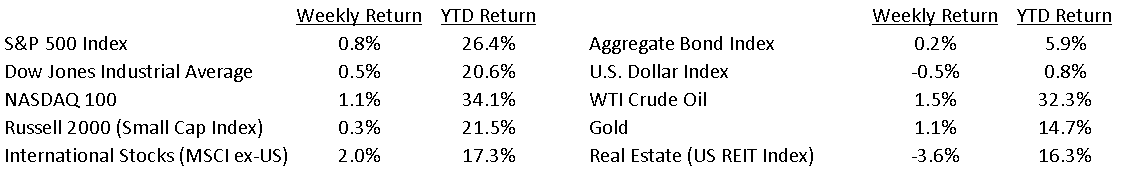

Financial Market Update

Dissecting Headlines: USMCA

The United States-Mexico-Canada Agreement, or USMCA, will replace the current North American Free Trade Agreement (NAFTA) that governs trade in North America. The USMCA was signed by U.S. President Donald Trump, Mexican President Enrique Peña Nieto, and Canadian Prime Minister Justin Trudeau on November 30, 2018, but has yet to be ratified by all three governments. Mexico ratified the agreement in June 2019. Canada and the U.S. still need to ratify.

The new Agreement would allow the U.S. better competitive position in the dairy industry in Canada, raise the content of automobile to 75% domestic in each country, provide more competition in automobiles by requiring higher wages for Mexican auto workers, and update some intellectual property protections.

A long-term trade agreement in North America would be beneficial for all three economies.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint December 16, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.