Investors were surprised late last week by the announcement that the U.S. would impose a 5% tariff on all goods imported from Mexico and gradually increase them until the flow of illegal immigrants stopped. The economic and political uncertainty of this policy added to the uncertainty currently in the market from the U.S.—China trade standoff.

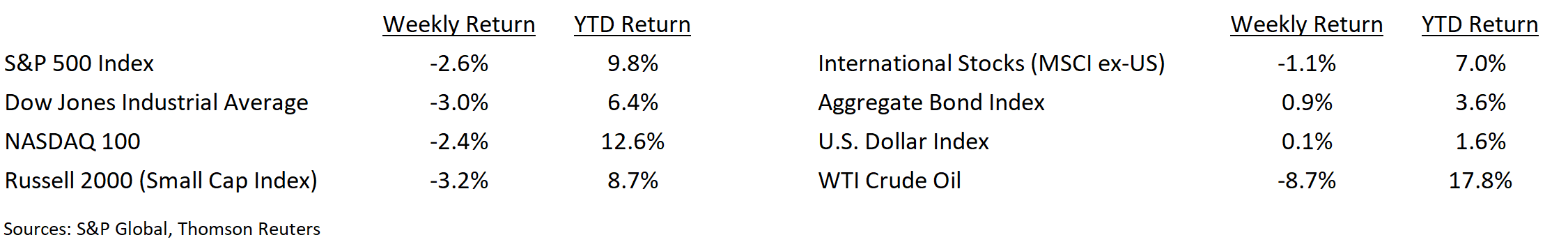

Despite what was a reasonable First Quarter earnings season and a good economic backdrop, investors seized on uncertainty and the month of May ended with the major market averages posting their first monthly declines of the year with the S&P 500 down 6.4%, NASDAQ down 8.4%, and Dow Industrials down 6.3%. Crude oil has also seen a steep two-week decline, falling 14.8%. Ten year treasury yields declined from 2.51% to 2.13% during the month.

The market’s sharp recovery from December’s lows has stalled as fear has reinserted itself. Market averages are near oversold levels and we would expect volatility to increase as the absence of corporate earnings news leaves investors to rely on economic data and political headlines to drive sentiment.

We believe a patient Federal Reserve Board and healthy U.S. consumer should add some calm to the current fears. The fear that dominated the Fourth Quarter was that the Fed would be too aggressive. That has passed and the Fed should stay on hold or look to possibly reduce interest rates if economic data presents a weakening economic outlook. Declining oil prices should translate into lower retail gasoline prices and provide consumers with some additional discretionary spending power.

Financial Market Update

Dissecting the Headlines: The Beige Book

Each of the twelve Federal Reserve Banks gather regional data on economic conditions that is released eight times a year in a report titled the Commentary on Current Economic Conditions, more commonly known as the “Beige Book”. The Beige Book provides granular information and anecdotes through interviews with business contacts, economists, market experts, and other sources. It is a qualitative report and meant to characterize current dynamics and identify emerging trends in the economy.

As an example, commentary from the April 2019 Beige Book from our region in Atlanta stated “economic activity grew modestly” and “retail sales grew slightly, tourism remained robust, home sales improved, and commercial real estate activity accelerated”. These observations at the regional level and aggregated at the national level provide insight to policy makers.

The next Beige Book release is scheduled for June 5th. Its insights could impact economic activity and policy in coming months.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint June 3, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.