The tug o’ war between economic improvement and the resurgence of COVID-19 has the equity market gyrating back and forth depending which sentiment rules the headlines each day. We have a few weeks before the second quarter earnings reports start, so the economic data and COVID headlines are the main catalysts for market direction. An example from last week would be the strong retail sales data for May contrasted with resurgence of COVID cases in several states.

Retail sales for May were +17.7% month-over-month. Several beleaguered categories showed a sharp rebound such as apparel (+188%), furniture (+88%), and motor vehicles and parts (+44%). Gasoline stations posted a 13% increase as driving miles have picked up. Online retail was 9% higher after being one of the few positive categories in both March and April. As mentioned last week, a combination of discretionary cash flow and a pent-up demand to use it likely persists in the near-term.

The current consensus for second quarter S&P 500 earnings is for a year-over-year decline of 42.9% on a 12.0% revenue decline. The bulk of the COVID related impact to the economy should be experienced in the second quarter and should mark a trough in both earnings and GDP decline in the U.S. Second quarter GDP is currently forecast to be down 34.8%. Barring another COVID-like event, we should see incremental growth in the second half of 2020 and above-average growth in 2021.

Initial unemployment claims for the week of June 13th decreased to 1.508 million versus 1.566 million the week prior. The four-week moving average decreased to 1.774 million. Continuing Claims for June 6th were 20.544 versus 20.606 the week prior. The weekly new claims are being counterbalanced by new jobs created and furloughed workers returning to jobs. We view gains in employment to be a significant indicator of the health of the economy and a measure of a return to normal economic and social activity.

In our Dissecting Headlines section we look at Durable Goods Orders.

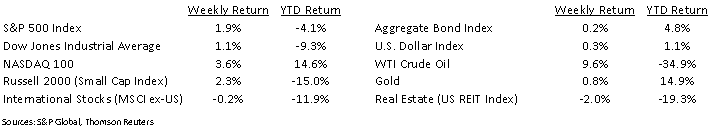

Financial Market Update

Dissecting Headlines: Durable Goods Orders

Durable goods are items that are meant to have a longer lifespan such as furniture, appliances, and motor vehicles, as well as industrial items such as machinery, aircraft, and military hardware. The monthly Durable Goods report released by the Census Bureau provides data on durable goods shipments, inventories, and new orders.

The new orders receive attention each month as they can indicate demand in the economy. Transportation goods such as trucks and commercial airplanes can have a long lead time and a lumpy order pattern, so the report presents data with and without this category. Military equipment can likewise have an irregular pattern.

Durable goods orders declined sharply in March and April as the economy was hit with the COVID-19 shutdown. Especially hard hit was the transportation category as commercial airline traffic declined and airlines struggled with financial liquidity. Durable goods for April were –17.2% from March and –7.4% excluding transportation.

For May, durable goods orders are expected to rebound approximately 12% and 4% excluding transportation goods. The report is scheduled for June 25th.

Current and previous Durable Goods reports can be found on the Census Bureau website: https://www.census.gov/manufacturing/m3/index.html

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint June 22, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.