The equity market gave back some of its recent gains last week, but volatility also decreased which we view as a welcome signal relative to the higher levels of volatility we’ve seen over the past few weeks. Uncertain timing on a return to normalcy in society and the economy is likely to weigh on investor sentiment until evidence emerges that we’re closer to the end than the beginning.

We have been monitoring employment as a key metric to gauge the potential economic impact from COVID-19. First-time unemployment claims for the week of March 28th increased to 6.648 million versus 3.307 for the week of March 21st. The four-week moving average increased to 2.612 million from 1.004 million. Monitoring this data over the next few weeks is going to be important to see where unemployment claims peak and to set the bar for how much employment needs to be generated as the economy recovers post COVID crisis.

As we move into the end of the first quarter of the year, we should get better clarity into the impact of the current environment on many individual companies and industries when companies start reporting their quarterly earnings. We think investors are likely going to be less focused on the impact in the quarter and more likely on what actions companies are taking to operate in the current economic environment.

In our Dissecting Headlines section, we look at what Recession means and how the equity markets responded versus Gross Domestic Product (“GDP”) data in 2008-2009 as an example of how markets anticipate the future.

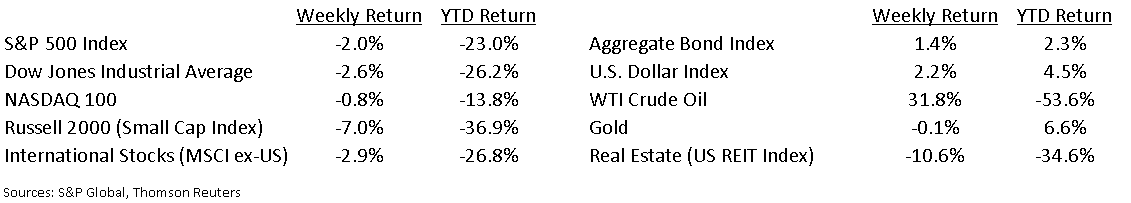

Financial Market Update

Dissecting Headlines: Recession

A recession is defined as two consecutive quarters of contracting (or negative) GDP growth. The economy has been growing in the 2% to 3% range the past few years. First quarter GDP is likely to be flat or negative, and 2nd quarter GDP should be negative as we likely don’t get back to normal activity levels for several months and the bulk of the COVID-19 impact should be felt in the second quarter. If we look back at the 2008-2009 financial crisis, the fourth quarter of 2008 was -7.2% GDP, first quarter of 2009 was -4.5%, and second quarter of 2009 was -1.2%.

The stock market bottomed in March of 2009, before the first quarter of 2009 data was known. The stock market was taken by surprise by the Lehman bankruptcy and fell sharply in the fourth quarter of 2008, but then started rebounding before it was even proven that there was the second quarter of GDP contraction. Just like we see the stock market decline on worry/fear, we also see it trade higher as optimism/greed return. As mentioned above, the current unknown is what event or events start to convince both investors and the general public that we’ve turned the corner on the spread of the virus and resumption of activity levels return.

Advance report on first quarter GDP is currently scheduled for release on April 29th. That will be a first step in understanding the recession scenario.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint April 6, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.