Equity markets took another ride last week. Optimism was high early in the week following a Consumer Price Index (CPI) report that showed slowing inflation, but pessimism returned following the Federal Open Market Committee (FOMC) meeting which indicated the final level on short-term interest rates is projected to be higher than previously expected.

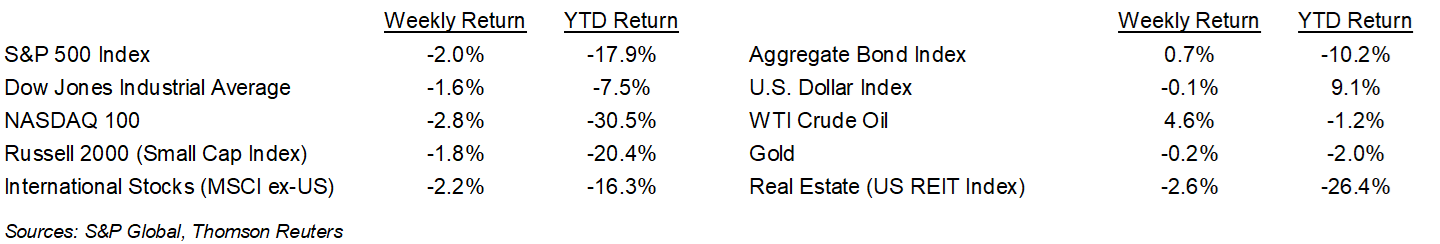

The S&P 500 was -2.0% for the week, the Dow was -1.6%, and the NASDAQ was -2.8%. The 10-year U.S. Treasury note yield decreased to 3.482% at Friday’s close versus 3.567% the previous week.

The November CPI report showed +0.1% month-to-month and core CPI, which excludes food and energy prices, was +0.2% month-to-month. The month-to-month change was lower (less inflationary) than expectations. Year-over-year, CPI was +7.1% and core CPI was +6.0%.

The FOMC increased the Fed funds rate by 0.50% to a 4.25% to 4.50% range. In the quarterly Summary of Economic Projections, the FOMC indicated its projected terminal Fed funds rate for the cycle is now 5.00% to 5.25% versus 4.50% to 4.75% previously.

In our Dissecting Headlines section, we look at the National Bureau of Economic Research and its position as the official organization able to declare a recession.

Financial Market Update

Dissecting Headlines: National Bureau of Economic Research

A recession is defined as a significant decline in economic activity that is spread across the economy and lasts more than a few months. Many market watchers have used the indicator of two quarters of negative GDP growth to declare that economic condition. In reality, a handful of economists from the National Bureau of Economic Research (NBER), a private nonprofit organization, meet to consider many factors and declare whether the U.S. economy is in a recession or not based on the above definition.

The members of NBER’s Business Cycle Dating Committee are Robert Hall of Stanford, Robert J. Gordon of Northwestern, James Poterba of MIT, Valerie Ramey of UCal – San Diego, Christina Romer of UCal – Berkeley, David Romer of UCal – Berkeley, James Stock of Harvard, and Mark W. Watson of Princeton.

These economists will consider additional factors such as employment, industrial production, and personal consumption to determine the depth, dispersion, and duration of a contraction in economic activity. They are the group that makes the official declaration of a recession. They are also the committee that declares when a recession is over.

Recessions are sometimes declared in hindsight, so fear of a recession is what can sometimes cause investors and consumers to change their behaviors, so the actual declaration of a recession may be a moot point except for pundits that want to say they predicted it correctly. Regardless, the stock market tends to be a forward-looking mechanism, and may rise to look beyond a recession, especially one that feels like the only thing it lacks is an official declaration.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 19, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.