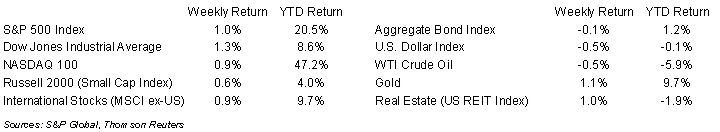

Equities maintained their upward movement during the holiday shortened week. The weekly return for the S&P 500 Index was +1.0%, the Dow was +1.3%, and the NASDAQ was +0.9%. All eleven sectors in the S&P 500 Index were positive for the week led by the Health Care, Consumer Staples, and Communication Services sectors. The 10-year U.S. Treasury note yield increased to 4.484% at Friday’s close versus 4.441% the previous week.

The minutes of the November Federal Open Market Committee (FOMC) meeting indicated that while Federal Reserve officials agreed inflation was on the right path, they would not hesitate to raise rates again if data indicated that progress toward the 2% goal was insufficient. The next data point comes this week with the release of the Personal Consumption Expenditures (PCE) Price Index. Expectations for the FOMC to hold rates steady at the December meeting are currently 96.8%.

With 481 companies in the S&P 500 Index complete on third quarter earnings reporting, S&P 500 earnings are expected to grow by 7.1% year-over-year on revenue growth of 1.5% for the quarter. This is a substantial increase from the 1.6% earnings and 0.8% revenue growth forecasted at the start of the earnings reporting period. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.6% on revenue growth of 2.0%.

In our Dissecting Headlines section, we look at the holiday shopping season.

Financial Market Update

Dissecting Headlines: Holiday Shopping

Based on data from Mastercard Spending Pulse, Black Friday shopping was 2.5% higher year-over-year. There was a clear divide between online shopping which increased 8.5% and in-store sales which increased 1.1%. Today is Cyber Monday and it is also expected to be an active shopping day.

The National Retail Federation’s (NRF) holiday spending forecast expects spending in November and December should grow 3% to 4% year-over-year to the $957.3 to $966.6 billion range. This is the lowest growth rate since the 1.7% growth in 2018. It trails 2022’s 5.4% growth, 2021’s 12.1% growth, and 2020’s 9.1% growth. The NRF’s measurement period is November 1st to December 31st, but 43% of shoppers surveyed say they start their holiday shopping before November to spread out their budget, avoid last minute shopping, and avoid crowds.

Online shopping continues to outpace overall shopping with a 7% to 9% increase forecast for this year to a range of $273.7 to $278.8 billion. Online shopping has become the preferred destination with 58% of shoppers saying they plan to purchase something online this year.

With inflation impacting most areas of essential and discretionary spending, 62% of shoppers surveyed are looking for sales and promotions to stretch their dollars. This started early with 40% of shoppers surveyed saying they specifically took advantage of sales offered in October to start their holiday shopping. That trend is continuing through the Thanksgiving period with promotions tempting shoppers all weekend. Top selling categories this weekend were smartwatches, televisions, toys, and gaming.

The period between Thanksgiving and Christmas has an extra shopping day in 2023 with 32-days versus 31-days in 2022 and 2021. For the procrastinators, Christmas is on a Monday this year, so a last minute trip to the store is always possible as well.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 27, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.