Positive economic data continues to provide an optimistic catalyst to the stock market. The June ISM Manufacturing Index moved back up to 52.6 indicating economic expansion. The June employment report showed nonfarm payrolls of 4.8 million which were well ahead of expectations and built on the 2.7 million jobs created in May. The unemployment rate dropped to 11.1% from 13.3% the month prior and April’s peak of 14.7%. Despite these tangible advances in economic activity, we remain well below the levels the economy was operating at pre-COVID.

This is our last quiet week before the second quarter earnings reporting season kicks off next week. S&P 500 earnings for the second quarter are forecasted to decline 43.1% on a 11.7% revenue decline. This is coincident with U.S. second quarter GDP currently forecast to be down 34.8%. We will be looking for corroborating evidence in the earnings reports that the second quarter is the trough in the economy and that companies have adapted to business moving forward. Barring another COVID-like event, we should see incremental growth in the second half of 2020 and above-average growth in 2021.

The news on the June employment report pushed the weekly unemployment claims data into the background last week as they were both reported Thursday. Initial unemployment claims for the week of June 27th decreased to 1.427 million versus 1.482 million the week prior. The four-week moving average decreased to 1.504 million. Continuing Claims for June 20th were 19.290 versus 19.231 the week prior. Several more months of sequential improvement in employment are necessary to return the U.S. economy to pre-COVID levels.

In our Dissecting Headlines section, we look at the breakout of the manufacturing and services sectors of the economy.

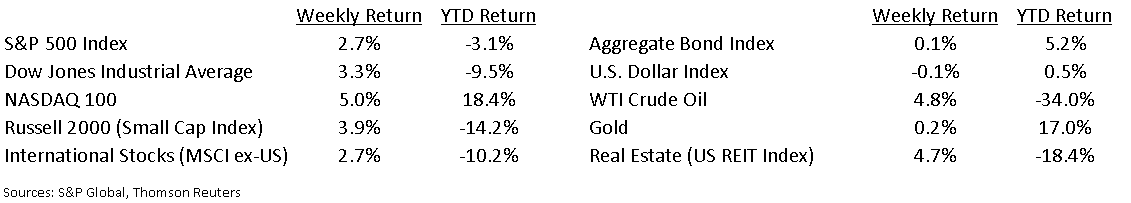

Financial Market Update

Dissecting Headlines: Manufacturing versus Services

Last week we highlighted the reports from The Institute for Supply Management (ISM) that measure activity in the manufacturing and service sectors of the economy. While both are important elements of the economy, manufacturing (including exports) is approximately one-third of the economy, while services (“non-manufacturing” in the ISM Report) is approximately two-thirds.

The offshoring of manufacturing over the past few decades, growth in financial and healthcare services, and an overall shift to an intellectual capital economy has made services an increasing part of the economy. A modest contraction in manufacturing can be compensated by an expansion in services.

The overall size of the economic is measured by GDP (“Gross Domestic Product”) which, based on 2019 GDP, is 68% personal consumption, 18% government spending, 17% business investment, and negative 3% net exports. Within personal consumption, about two-thirds is services and one-third is products.

The June ISM Manufacturing Report improved to 52.6 from 43.1, indicating expansion. The Non-manufacturing Report is scheduled for release later this morning. Like the Manufacturing Index, it had been in decline (reading below 50.0) in April and May as the COVID-19 forced closure of much of the economy. Sustainable improvement in both key parts of the economy will be necessary to return to pre-COVID levels.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint July 6, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.