Second quarter earnings season takes center stage this week as 56 companies in the S&P 500 Index are scheduled to report earnings results. Most major banks will report earnings and we can see how they are navigating the current interest rate environment. Several industrial companies will also report earnings results and we can get some insights on how trade and tariff issues are impacting current results and also longer-term decision making. Current consensus expectations for the S&P 500 Index is for earnings to be down 0.4% year-over-year and revenue to grow 3.3%.

Following a week of multiple appearances from Federal Reserve Chairman Jerome Powell, there is strong consensus for a 0.25% reduction in the Fed’s short-term interest rate target. Concerns over trade tensions, a weaker global economy, and low inflation are all contributing to the lower rate outlook. The next Federal Open Market Committee meeting is scheduled for July 30th—31st. A 0.25% change in rates at that time would reduce the range from 2.25% – 2.50% to 2.00% – 2.25%.

A drop in short-term interest rates has historically stimulated economic growth as the lower cost of borrowing from banks and other financial institutions has encouraged consumers and businesses to borrow and spend money. Given the flat yield curve, intermediate and longer term interest rates are already low and there isn’t a lot of room for longer term rates to follow lower. Borrowing tied to longer term rates may not accelerate, especially given uncertainty in the economic outlook.

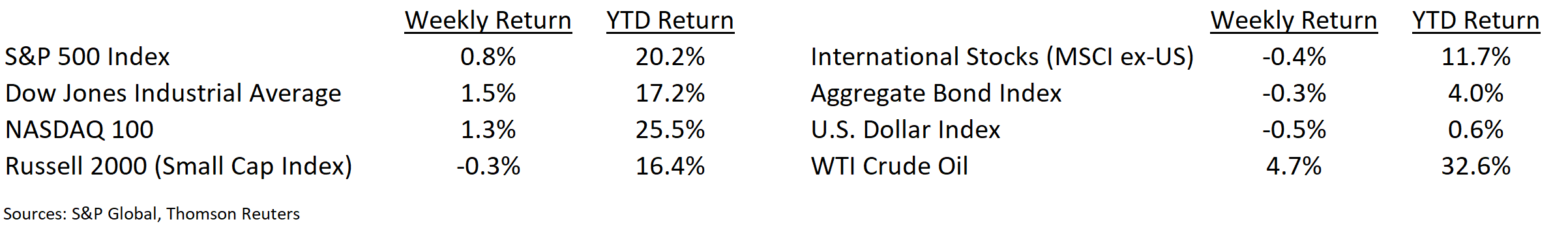

Financial Market Update

Dissecting Headlines: FOMC Minutes

A few weeks after each Federal Open Market Committee meeting, the minutes of the meeting are released. These meeting minutes can offer detailed insights regarding the FOMC’s stance on monetary policy and what they can mean for future interest rate decisions.

This past Wednesday the minutes from the June 18th-19th FOMC meeting were released. While the FOMC did not reduce interest rates at the June meeting they did express concern that economic risks had tilted to the downside due to uncertainty about trade. Some committee members also said a reduction in interest rates was warranted to manage risk and cushion the effects of possible future adverse shocks to the economy.

This information released in the June meeting minutes coupled with the Fed Chairman Powell’s comments during the week has increased expectations that the FOMC will reduce short-term interest rate at its July meeting.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint July 15, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.