Uncertainty over the economic impact of the coronavirus (COVID-19) continues to negatively impact markets. The declaration of a national emergency on Friday allows coordinated action and financial resources to be used to shore up the economy and provide assistance to public health organizations. In our Dissecting Headlines section, we look at the national emergency declaration from Friday and why national emergencies need to be declared to deal with crisis situations.

The Federal Reserve lowered short-term interest rates to a target range of 0% to 0.25% and is planning to purchase $700 billion of bonds ($500B treasury bonds and $200B mortgage-backed bonds) to keep ample liquidity in the banking system. The action was done as part of a global coordinated effort along with Canada, the United Kingdom, Japan, the European Central Bank and Switzerland. Fed Chairman Powell reiterated that the Fed is prepared to use the full range of tools at its disposal to keep the economy on stable footing.

Additional legislation is in front of Congress to address specific actions and we expect those to be passed in the coming week. Treasury Secretary Steve Mnuchin said we are only in the “second inning” of actions to support the economy.

While strong measures are being taken to minimize the economic impact of the crisis, news flow regarding COVID-19 is likely to have a bigger impact in the minds of consumers and investors.

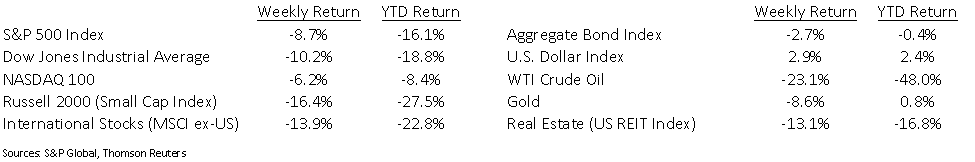

Financial Market Update

Dissecting Headlines: National Emergencies

President Trump declared a national emergency to deal with the coronavirus. The declaration comes as part of The National Emergencies Act of 1976. The Act allows the President to activate emergency powers to deal with a crisis from a Congressionally approved list of 136 powers. The President needs to notify Congress and Congress can terminate an emergency declaration with a joint resolution.

National emergencies occur more than one might think. The declaration needs to be made to marshal resources to deal with an emergency. Since the passage of the National Emergencies Act, every U.S. President has declared multiple national emergencies with Jimmy Carter (2), Ronald Reagan (6), George H.W. Bush (4), Bill Clinton (17), George W. Bush (12), Barrack Obama (13) and Donald Trump (5) all needing to deal with crisis situations at various points in time. Many emergencies declared by past presidents are still in effect such as the 1979 declaration by Jimmy Carter to block Iranian government property as part of the hostage crisis.

Friday’s declaration included funding to deal with the coronavirus to include expansion of testing through a public/private partnership with retailers, diagnostic, and healthcare companies. The President also announced the United States would be purchasing oil for the Strategic Petroleum Reserve and that interest on government-based student loans would be waived for a period of time. Additional actions are likely to be taken under the declaration over the next few weeks.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 16, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.