The Chinese government’s move to weaken its currency relative to the U.S. Dollar rattled global markets early last week. The Yuan/Dollar exchange rate passed through the 7 Yuan-to-the-Dollar level. This makes the Chinese currency weaker (see “Currency Pegging” explanation below) and aids the pricing of Chinese exports in the global markets.

The concerns over the impact of the sudden currency shift caused a rise in equity market volatility sending the Volatility Index to its highest level since the December 2018 market correction. The Volatility Index, or VIX, rises when there is fear or pessimism on the direction of the market based on the volatility priced into S&P 500 Index futures. The VIX eased later in the week as Yuan/Dollar exchange rates stabilized.

We are now headed into the tail end of second quarter earnings with 450 companies in the S&P 500 having reported quarter-to-date. Seventy-three percent of companies have reported earnings above expectations, 18% below expectations, and 8% in-line. The current consensus expectations for the S&P 500 Index earnings growth for the second quarter increased to +2.8% from +2.7% the week prior and versus expectations for a 0.4% decline at the start of the earnings reporting season. The “earnings recession” has yet to materialize. The expectation for revenue growth for the quarter increased week-to-week to +4.7% from +4.5%. Many of the companies in the S&P 500 Index that are still to report earnings are retailers which can provide good insight to the current health of the consumer.

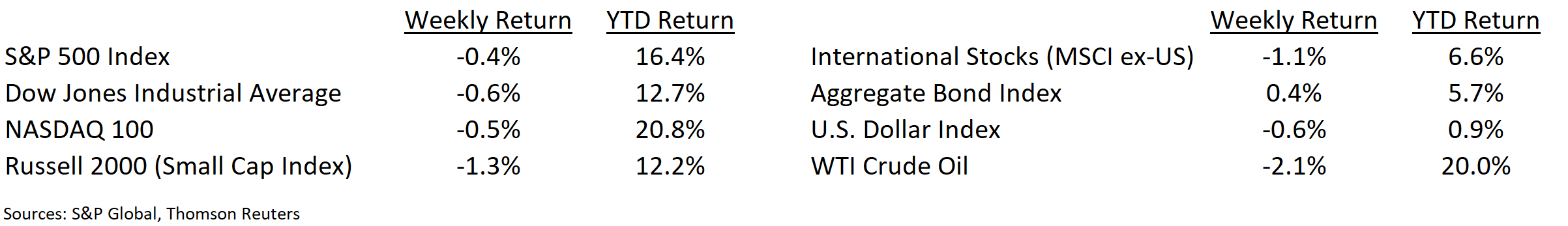

Financial Market Update

Dissecting Headlines: Currency Pegging

The exchange rate between major currencies around the world such as the U.S. Dollar, Euro, Japanese Yen and Swiss Franc are set by market supply and demand. Other currencies such as the Chinese Yuan are set through a fixed exchange rate, or peg, relative to one of the major currencies which in the case of China is the U.S. Dollar. The peg is set by the Chinese government and they can, as they did this week, lower the peg to devalue their currency relative to the U.S. Dollar.

The exchange rate for Yuan to the Dollar had been less than 7 Yuan to 1 Dollar for over a decade. This week, China moved the peg to over 7 Yuan/Dollar (this weakens the Yuan), as a defense in the trade war to keep Chinese exports price competitive globally. The move also makes imports into China more expensive for the Chinese. This can dissuade demand of global products by the Chinese. The Chinese government is also likely to spend its foreign exchange reserves (it holds currencies of other countries) to offset import inflation on vital commodities such as crude oil.

Currency has become the latest tool in a trade war between the world’s two largest economies.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint August 12, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.