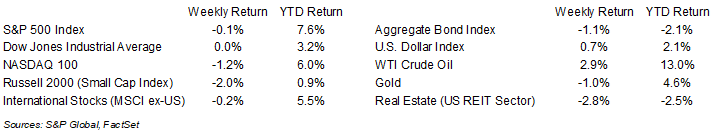

Stubborn inflation data kept stocks muted last week. For the week, the S&P 500 Index was -0.1%, the Dow was flat, and the NASDAQ was -1.2%. The best performing sectors in the S&P 500 Index were the Energy, Materials, and Consumer Staples sectors, while the Real Estate, Consumer Discretionary, and Technology sectors lagged. The 10-year U.S. Treasury note yield increased to 4.308% at Friday’s close versus 4.077% the previous week.

The February Consumer Price Index (CPI) rose 0.4% month-over-month and 3.4% year-over-year. Core prices, which exclude the impact of food and energy prices, rose 0.4% month-over-month and 3.8% year-over-year. Stubborn inflation potentially delays the timing of Federal Reserve interest rate cuts. The highlight on this week’s calendar is the Federal Open Market Committee (FOMC) meeting on Tuesday and Wednesday. While a change in rates is unlikely at the meeting, the FOMC will publish its quarterly Summary of Economic Projections. This information could better align expectations for monetary policy for the remainder of the year. CME Fed funds futures currently forecast an initial rate cut in June.

The fourth quarter earnings reporting period is near complete with 498 companies in the S&P 500 Index already reported. Fourth quarter earnings growth for the S&P 500 Index should be 10.0% with revenue growth of 3.7%. For full-year 2023, S&P 500 Index earnings should grow by 4.1% with revenue growth of 2.4%. For full-year 2024, earnings are expected to grow by 9.8% with revenue growth of 4.7%.

In our Dissecting Headlines section, we look at the recent rise in oil prices.

Financial Market Update

Dissecting Headlines: Oil Prices

Oil prices have been on a stealthy rise this year. After trending below $70/barrel in December, prices have recently topped $80/barrel. Last week, the International Energy Agency (IEA) forecast oil markets will be in a deficit for 2024. IEA upped their demand growth by 110,000 barrels to 1.3 million barrels a day growth. Reasons cited included a stronger U.S. economic outlook and the increased need for ship fuel, as vessels take longer routes to avoid Houthi attacks in the Red Sea. Extended OPEC+ production cuts have continued to restrict supply.

While we are still a few months away from the summer driving season in the U.S., gasoline prices are on the rise. In January, the national average gasoline price, as measured by the American Automobile Association (AAA), was $3.09/gallon. This has since risen to $3.47/gallon (+12.3%). Prices are about even with this period in 2023, $3.47/gallon versus $3.45/gallon, and well below the spike seen in 2022 following the Russian invasion of Ukraine.

With inflation remaining stubborn in many areas such as housing, and higher interest rates impacting consumer debt payments, higher gasoline prices can be an additional burden for consumers. One bright spot is that diesel prices are still lower year-over-year, $4.03/gallon versus $4.31/gallon, reducing supply chain and shipping costs for many consumer goods.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 18, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.