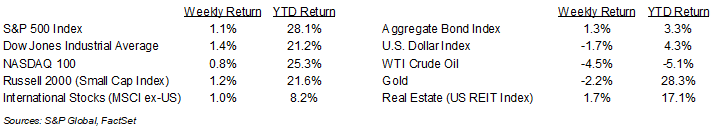

The equity markets continued their post-election gains, turning November into the best month of the year. For the week, the S&P 500 was +1.1%, the Dow Jones Industrials +1.4%, and the NASDAQ +0.8%. The Consumer Discretionary, Health Care, and Real Estate sectors led the market, while the Energy, Technology, and Materials sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.193% at Friday’s close versus 4.418% the previous week.

With a Federal Reserve policy meeting scheduled for December 18th, this Friday’s Employment Situation Report for November could impact investors’ outlook for what the Fed may do. Current expectations are for 200,000 new jobs created in November and the unemployment rate to inch up to 4.2% from 4.1% in October. Current CME Fed funds futures show a 65% probability of a 0.25% reduction in the Fed funds rate at the meeting to a 4.25% to 4.50% target range. The Fed should also issue an updated Summary of Economic Projections at the meeting, providing a road map for the first quarter of 2025. Fed funds futures for the first quarter currently show an additional 0.25% reduction in interest rates.

We are nearly complete with the third quarter earnings reporting period. Reports continues this week with 11 companies in the S&P 500 Index scheduled to release results. Third quarter earnings growth is currently forecast at 5.8% year-over-year with revenue growth of 5.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.4% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at current holiday shopping trends.

Financial Market Update

Dissecting Headlines: Holiday Shopping

Early reads on Black Friday shopping indicate consumer spending remains robust. Based on data from Mastercard SpendingPulse, U.S. retail sales, excluding automotive, were +3.4% on Black Friday compared to 2023. The spending growth was led by online retail sales which grew 14.6% versus in-store sales which grew a more modest 0.7%.

This is consistent with the National Retail Federation’s (NRF) holiday spending forecast. NRF expects spending in November and December should grow 2.5% to 3.5% year-over-year to the $979.5 to $989.0 billion range. The NRF’s measurement period is November 1st to December 31st, but 45% of shoppers surveyed say they start their holiday shopping before November to spread out their budget, avoid last minute shopping and avoid crowds, and pursuing early promotions.

Online shopping continues to outpace overall shopping with an 8% to 9% increase forecast for this year to a range of $295.1 to $297.9 billion. Online shopping has become the preferred destination with 57% of shoppers saying they plan to purchase something online this year.

Gift cards are the most popular item purchased across all retail categories with 53% of shoppers planning to purchase them. Other top categories include clothing and accessories at 49%, books and media at 28%, and personal care and beauty items at 25%.

The period between Thanksgiving and Christmas is shorter this year with only 26 days versus 31 days last year. Even with an early start in October, 62% of shoppers expect to still be buying gifts in December.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 2, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.