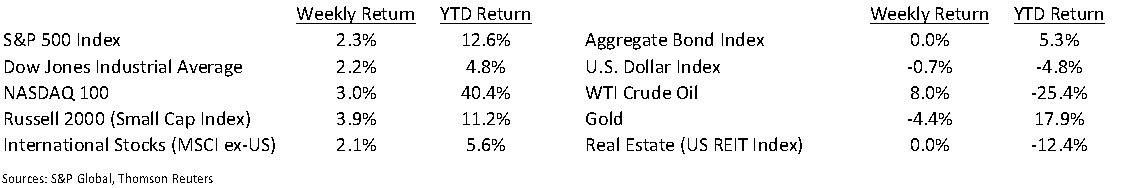

The Thanksgiving week mood in the market was generally positive. The Dow Jones Average was +2.2%, the S&P 500 Index was +2.3%, and the NASDAQ 100 Index was +3.0%.

As we head into the last month of 2020, investors are likely to continue the focus on the optimism of COVID-19 vaccine distribution and their potential to return societies and economies back to normal, especially in hard hit areas still under extreme restrictions. They are also likely to focus on the rising number of COVID-19 cases, especially as gatherings and travel over the Thanksgiving holiday raise concerns that the virus spread may accelerate while the vaccines should not see widespread distribution for several months.

The labor market had a second consecutive increase in initial unemployment claims during the week of November 21st with claims rising to 778,000 versus 748,000 the previous week. Additional business restrictions in some states are likely contributing to the increase. Continuing claims for the week of November 14th were 6.071 million versus 6.370 million the week prior.

In our Dissecting Headlines section, we look at updated information on holiday shopping.

Financial Market Update

Dissecting Headlines: Holiday Shopping Update

Last week we reported on the National Retail Federation (NRF) survey that found 59% of shoppers had made holiday purchases ahead of Black Friday. This past Monday, the NRF came out with its annual Holiday sales forecast. The NRF is forecasting year-over-year holidays sales to increase in a range of 3.6% to 5.2%. As a comparison, 2019’s holiday sales rose 4.0% and the average over the last five years has been a 3.5% increase. Many retailers have better positioned themselves for online versus in-store sales this year. The NRF estimates that online sales should be up 20% to 30%.

Black Friday in-store foot traffic was estimated to be down 50% from last year. This was likely due to a combination of factors comprising of COVID restrictions on store capacity and social distancing, as well as many retailers not offering “door buster” specials and instead focusing on online sale promotions. Online shopping on Black Friday rose 22% as measured by Adobe Analytics. However, this was at the low-end of Adobe’s forecast of +20% to +42%. Adobe is forecasting today’s Cyber Monday sales to grow 15% year-over-year. Given the hard shift to online shopping this year, we may see sales more spread out over the next few weeks rather than peak days normally seen during the period.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint November 30, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.