The final significant week of second quarter earnings brought upside surprises from several big retail companies, but an escalation of tariffs between the U.S. and China overshadowed everything and ended the week on the downside for the major equity indices.

On second quarter earnings, 482 companies (>96%) in the S&P 500 have reported quarter-to-date. Seventy-four percent of companies have reported earnings above expectations, 18% below expectations, and 8% in-line. The current consensus expectations for the S&P 500 Index earnings growth for the second quarter increased to +3.2% from +2.9% the week prior and versus expectations for a 0.4% decline at the start of the earnings reporting season. The expectation for revenue growth for the quarter is +4.7%.

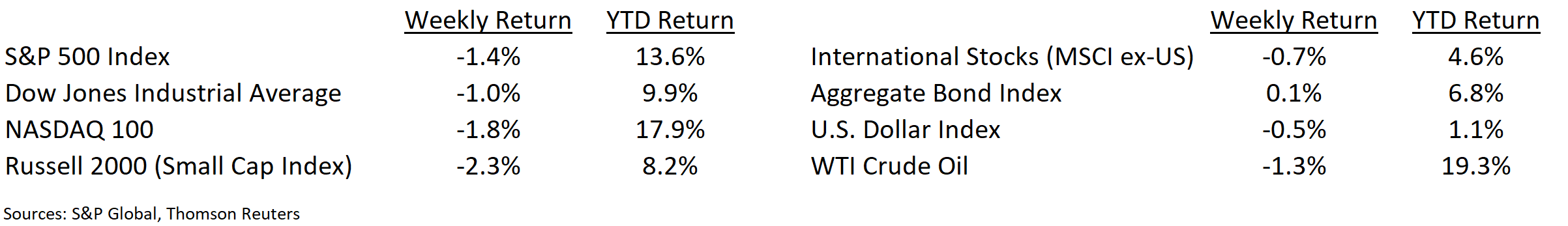

U.S.—China trade issues dominated market action into week’s end as China announced retaliatory tariffs on approximately $75 billion of U.S. goods to include agricultural, auto, and oil imports. This was in response to the tariffs on $300 billion of Chinese goods the U.S. announced a few weeks ago that are scheduled for September 1st and December 15th. President Trump responded with commentary suggesting further tariff increases as well as commenting that U.S. companies should seek alternatives to China and produce goods in the U.S. This escalation unnerved markets and the S&P 500 Index ended Friday down 2.6% and the week down 1.4%. This is the fourth consecutive weekly decline for the Index.

These trade headlines overshadowed Fed Chairman Jerome Powell’s speech at the Federal Reserve conference where he reiterated that the FOMC would act appropriately to maintain economic expansion but cautioned that monetary policy alone cannot counter business issues arising from international trade.

Headlines on economic and geopolitical events are likely to determine market direction for the next few weeks as the news flow from corporate earnings has largely finished. The G7 summit (see below), more trade and tariff news, and speculation about the September FOMC meeting should set the tone for markets this week.

Financial Market Update

Dissecting Headlines: The G7

The G7 summit was held this weekend in France. The G7 (“Group of 7”), is an intergovernmental economic organization consisting of seven of the world’s largest nations: Canada, France, Germany, Italy, Japan, United States, and United Kingdom. It was formed in 1975 as the G6 and expanded to include Canada the following year. It was the G8 from 1997 to 2014 when it included Russia. The European Union (“EU”) is included as a permanent guest.

The escalation of the U.S.-China trade dispute prior to President Trump leaving for the G7 summit likely made for interesting conversation with the other members upon his arrival. The agenda topic for this year’s summit is “the fight against inequality”, but discussion of global trade and economic growth, as well as the current environmental crisis in the Amazon, are likely major topics to be addressed between leaders.

These summits provide global leaders the opportunities to meet in person to discuss and settle key political, economic, and social issues and can have impact on financial markets.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint August 26, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.